Global oil supply long-term outlook H1 2019

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Why buy this report?

- Get our latest oil supply forecasts out to 2040, and our assessment of the key risks to these forecasts

- Understand the themes that will shape global oil supply in the short, medium and long term

- Learn how we expect geopolitical tensions to affect the oil market

What are the key takeaways from our latest report?

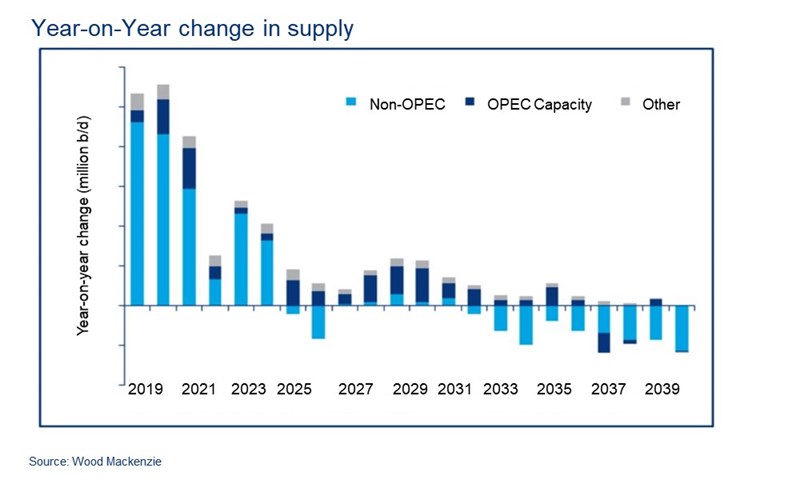

- Non-OPEC supply growth plateaus at 66 million b/d from 2024, an increase of 8 million b/d from 2018

- Strong upward revisions are dominated by the US Lower 48; but supported by upgrades to mature producers such as China and Norway, and emerging entrants including Guyana

- US Lower 48 crude and condensate peaks at 13.3 million b/d in 2024; Permian remains the key focus of activity

- OPEC crude oil capacity increases steadily through the forecast period, from 35 million b/d in 2018 to 38 million b/d in the early 2030s.

Purchase our report to access a complete set of datasets and charts, including this one, tracking year-by-year changes in supply for OPEC and non-OPEC regions to 2040. Scroll down for the full table of contents.

Report summary

Table of contents

- Global Supply

-

OPEC: long term capacity growth despite production cuts and Iran sanctions losses

- Capacity additions in Iran deferred as sanctions waivers end

- Iraq main focus for OPEC capacity additions, but risks emerging as Middle East tensions rise

- Venezuela: deteriorating operating conditions and US sanctions take toll of supply

-

Non-OPEC: near term growth transitions to stability longer term

- US Lower 48 in focus: core inventory continues to be limiting factor

- Long-term cost curve comes down

- The Majors in the Permian

-

Latin America in focus: key non-OPEC growth area outside of North America

- Brazil – a tale of two basins

- Guyana is the new kid on the block

- Longer term exploration is crucial to maintain growth in the region

Tables and charts

This report includes the following images and tables:

- Year-on-year change in supply

- US Lower 48 crude and condensate production outlook

What's included

This report contains:

Other reports you may be interested in

Global oil supply short-term update - July 2025

Minor changes to outlook as prices return to below $70/bbl

$1,350Global oil cost curves and pre-FID breakevens H1 2025

Deepwater developments are becoming more competitive, driven by new production in Latin America

$6,000Global oil supply short-term update - June 2025

Downward pressure on prices as OPEC+ returns volumes to market

$1,350