Supply chain call to action: navigating tariff uncertainty today

Our new checklist provides a list of urgent actions for supply chain resilience across the power and renewables industry

3 minute read

Isabel Schwartz

Vice President, Supply Chain Consulting

Isabel Schwartz

Vice President, Supply Chain Consulting

Isabel is a leader in the supply chain consulting practice.

Latest articles by Isabel

-

Opinion

Supply chain call to action: navigating tariff uncertainty today

-

Opinion

Navigating the impact of President Trump's tariffs on utility supply chains

-

Opinion

4 years into a difficult transformers market in the US, is there a potential end in sight?

-

Opinion

Supplier diversity programs: a new source of competitiveness and innovation for utilities in North America?

In today’s volatile trade environment, supply chain leaders are no longer just managing cost and logistics—they’re shaping corporate resilience. With the latest tariff hikes hitting steel, aluminum, and imports from key trading partners, organisations face immediate cost escalations and supply disruptions that demand swift action.

On 1st February, 2025, the US imposed 25% tariffs on goods from Canada and Mexico and 10% tariffs on Chinese imports. Then, just days later, a 30-day delay on Canadian and Mexican tariffs, now set to go in place on March 6, created a brief window for utilities and industrial players to assess the impact. However, Chinese tariffs remain, additional escalations have followed—including a 25% tariff reinstatement on all steel imports and increased aluminum tariffs – and threats of retaliatory tariffs from other countries add to the sense of anticipated disruption and urgency to act.

Why waiting is not an option

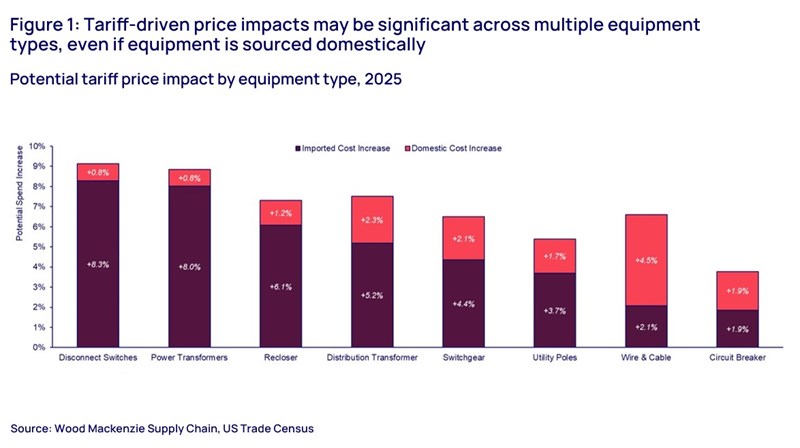

Recent analyses by Wood Mackenzie indicate that tariffs could lead to a 1% to 5% increase in total supply chain spending for US utilities. This impact is most significant in categories that have already faced considerable disruption and price escalation, such as transformers, switchgear, and other electrical equipment.

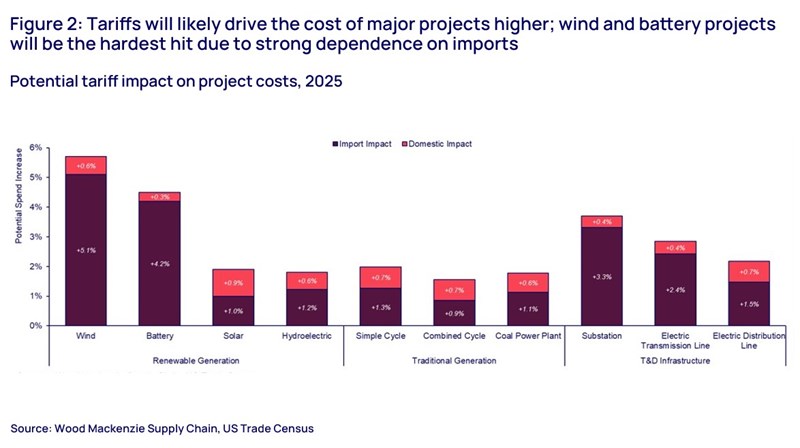

Additionally, as many utilities plan to invest heavily in major equipment purchases for upcoming capital projects, this impact could potentially increase further, as key equipment, even if sourced domestically, is heavily reliant on imported components that may be subjected to tariffs.

Across industries like power, renewables and utilities that have complex global supply chains, inaction is the biggest risk. The companies that act now to restructure sourcing, prepare renegotiation contract strategies, and optimize costs will be the ones that emerge stronger.

Tomorrow’s checklist: five moves to make today

Forward-thinking organisations are already executing five immediate actions to minimise financial exposure and increase supply chain resilience.

Read on for a short summary of a couple of the key actions that organisations must take to weather the coming storm, or fill out the form at the top of the page to download the full checklist.

1. Validate supplier sourcing

Question: Do you know where key equipment is procured from and if alternate options exist for your organisation?

Action: Assess current supplier dependencies, identify critical materials sourced from tariff-impacted regions, and establish alternative suppliers before cost surges disrupt operations.

2. Scrutinise contracts for risk-sharing language

Question: Do you know if your contracts protect the organisation from price impacts?

Action: Conduct a contract review to strengthen risk-sharing clauses, renegotiate pricing mechanisms, and implement protections against unexpected cost increases.

Fill out the form at the top of the page to read the remaining three points from our full checklist.

What’s next?

The power and renewables industry once again finds itself in a holding pattern, waiting for clarity on tariff policies. Volatile markets for supply chain have shaped organisations over the past 5-years on several milestone moments. The next 30-60 days will separate proactive leaders from those forced into reaction as companies respond to tariff uncertainty.

Evolving trade policy and other federal policies will have longer-term implications for supply and demand balances across key equipment and labor categories, which may have a larger impact on project costs and schedules than the tariffs alone. The best organisations aren’t just managing through this uncertainty—they’re using it to redefine their competitive advantage.

It’s time to act

How are you positioning your supply chain to lead? What strategic priorities have you listed in your tomorrow’s checklist to succeed?

Fill out the form at the top of the page to read our full checklist and learn the moves our experts recommend making today.