7 questions about Trump tariffs and their impact on the North American oil market answered

US threats and potential retaliation from Canada and Mexico create a range of possible scenarios

3 minute read

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Oil and refining market implications of Israel’s strike on Iran

-

Opinion

What is the impact of US tariffs on oil and refining?

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

-

Opinion

Global refinery closure outlook to 2035

Dylan White

Principal Analyst, North American Crude Markets

Dylan White

Principal Analyst, North American Crude Markets

Dylan leverages cutting-edge data to offer real-time insight into the oil industry.

View Dylan White's full profileAustin Lin

Principal Analyst, Refining and Oil Products

Austin Lin

Principal Analyst, Refining and Oil Products

Austin leads Wood Mackenzie's refined products research in the Americas.

View Austin Lin's full profileMarkets are already suffering whiplash from a slew of constantly changing headlines about US tariffs. With negotiations ongoing, the best stakeholders can do is be aware of the known unknowns and possible consequences. So, what could it all mean for North American oil?

We’ve just published an analysis of the potential implications of tariffs for North American oil markets, drawing on input from our North American Crude Markets Service, Macro Oils Service and Product Market Service. Fill out the form to download the full report or read on for brief answers to seven key questions about how the sector could be affected.

In the US administration’s unveiled plan, Canada and Mexico would both be subject to 25% import tariffs. However, Canadian energy – including oil and gas – is made an exception and granted a lesser 10% levy. We have based our analysis on these announced figures.

1. How would tariffs affect country level oil demand?

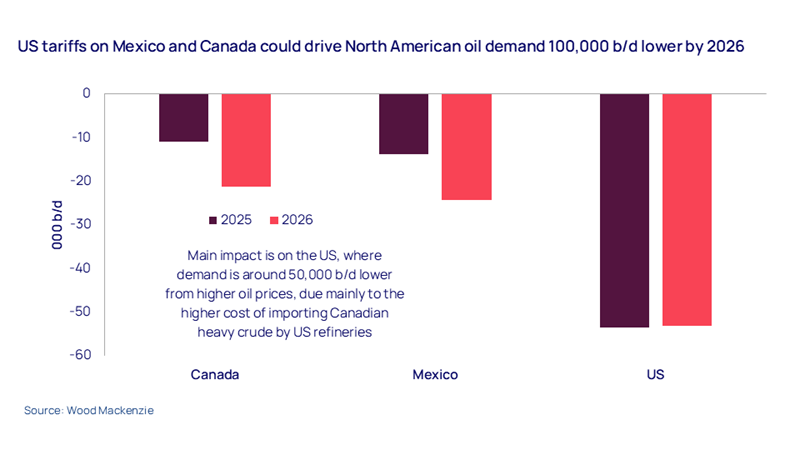

As well as lowering GDP growth for Canada and Mexico, planned tariffs would cause modestly higher refined product prices in the US, the combination of which would reduce overall North American oil demand by around 100,000 barrels per day (b/d). The main impact would be on the US, with demand around 50,000 b/d lower than our base case outlook.

2. How would Canadian trade flows shift under tariffs?

Currently, nearly half of Canadian crude is consumed in landlocked US markets that have limited access to alternate supply sources. In a 10% tariff scenario, we would expect Canada-to-US crude movements to largely persist to these markets, as well as to the US Gulf Coast. However, producers shipping oil via the Trans Mountain Pipeline System (TMX) could shift their focus to markets in Asia, at the expense of US West Coast refineries.

3. What crude backfill options exist for US refineries?

The heftier 25% tariff on Mexican crude would spur a more significant shift in trade flows, with large volumes that currently ship to the Gulf Coast directed to Europe and Asia. Coastal refiners could seek alternative sources of crude in the form of seaborne imports from both the Middle East – particularly Iraq – and Latin America, although US sanctions mean Venezuela isn’t currently an option.

4. Could the TMX take additional capacity?

The recently completed TMX provides greater access to non-US markets for Canadian oil. Flows have been strong since it entered service in 2024, with volumes reaching new heights in recent months. While already higher-than-expected flows limit additional capacity, system volumes could increase still further if tariffs are implemented.

5. What options are there for re-exporting Canadian imports into the US to other locations?

Under current law, volumes moving through the US solely for export are not subject to tariffs (this protection exists in US Code so couldn’t be changed through an executive action). Re-export would therefore be an option for Canadian barrels. However, given infrastructure constraints, a 10% import tariff wouldn’t materially shift the volume of Canadian oil processed in US Gulf Coast refineries to being re-exported to international markets.

6. What would be the price impacts from tariffs?

In theory, import duties are paid directly by the importer (US refiners, in this case). However, in a 10% tariff scenario, with limited re-exports from the US Gulf Coast, the benchmark price for Western Canada Select (WCS) would continue to be set by US Gulf Coast refiners. The cost of US tariffs would therefore largely have to be absorbed by Canadian producers. With tariffs of 25% redirecting Mexican supply elsewhere, US Gulf Coast prices for heavy crudes would probably rise slightly once new trading patterns have become established.

7. Could lower margins drive shut-in of Canadian production?

Steeper WCS discounts would hit profitability for Canadian producers. However, we don’t expect a 10% tariff would move the needle on margins enough to provoke widespread shut-ins at Canadian wells.

Remember to fill out the form at the top of the page to download the full report drawn from data and analysis by our expert North American Crude Markets team. This covers these topics in detail, and includes a full range of charts and data.