Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Copper production to become a growth driver in 2025 as capital allocation strategies diverge in mining

Copper production to become a growth driver in 2025 as capital allocation strategies diverge in mining

3 minute read

Wood Mackenzie's latest analysis shows a significant shift in capital allocation strategies within the mining sector, as production growth has become a primary focus amid increasing competition for capital investment.

According to Wood Mackenzie’s Metals and Mining Corporate analysis, three key factors are driving this shift:

- Increasing non-discretionary capital expenditure requirements

- Continued need for robust balance sheets to weather potential market volatility

- Growing focus on copper for both growth and diversification strategies

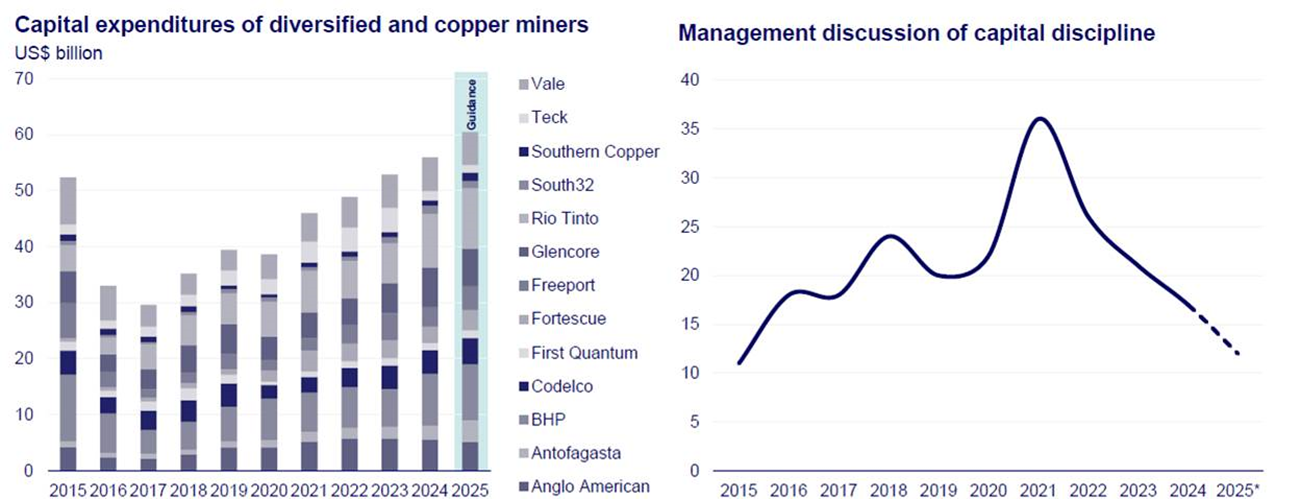

Major diversified and copper mining companies are guiding for higher capex again in 2025

Source: Wood Mackenzie CSAS – Guidance Tracker FactSet. Note: represents mentions of “disciplined capital” and “capital discipline” in transcripts of the Copper and Diversified Miners. *2025 is annualised YTD.

The analysis highlights that share buybacks are becoming less attractive at current valuations. The analysis highlighted that share buybacks had become less attractive at the valuations of the time. In fact, 2024 turned out to be a low point for buyback volumes among major mining companies, with notional returns dropping into negative levels for many.

James Whiteside, the head of corporate for metals and mining at Wood Mackenzie, stated, “Our analysis suggests that valuation multiples are not responding to higher payout ratios and buybacks are no longer delivering strong returns making the pivot to growth more appealing. Diversified companies seeking relevance through big payouts aren’t being rewarded, but the read across from copper miners is investing in production growth pays.”

Greenfield copper projects are starting to offer the most attractive returns for capital investment. However, not every mining company has a pipeline of growth opportunities. While maintaining capital discipline aims to ensure the best approach across metals and mining market cycles, it has increasingly become associated with maximizing shareholder returns, often at the expense of capital expenditure.

Wood Mackenzie forecasts that major copper companies will accelerate their reinvestment efforts over the next three years, on aggregate surpassing 100% of their operating cash flows. This shift will result in reduced payouts to shareholders. Overall, large, diversified mining companies are expected to establish a new typical reinvestment rate of over 50% of their operating cash flows. Consequently, these companies will likely lower their distributions to around 45%, and share buybacks are anticipated to decrease as well.

Whiteside added, “For some firms, embracing growth-oriented risk is now the optimal strategy. Our analysis shows that growth in the right commodities is rewarding, while higher variable payouts do not benefit companies struggling for relevance.”

The analysis also shows a divergence in strategies among major players. Rio Tinto and BHP, once seen as exemplars of capital discipline, now find themselves in different situations.

Rio Tinto has identified a range of opportunities across various commodities that have strong growth potential. The company's ongoing investments in projects such as Simandou, Oyu Tolgoi, AP60 (Aluminium), and newly acquired lithium ventures could increase its reinvestment rate to around 60% by 2025, maintaining a higher rate for the rest of the decade.

In contrast, BHP has several growth opportunities in copper in Chile that it is advancing and may reach a Final Investment Decision (FID) this year. However, it has limited other large-scale options aside from Jansen. Its more conservative strategy will likely result in its leverage falling below that of most peers over the next three years.

Whiteside concluded, “Miners are entering a new era of capital discipline. The market's response to these differing approaches will influence the long-term capital allocation decisions of major mining companies. Firms that can effectively balance growth investments with shareholder returns are likely to emerge as the winners in this changing landscape.”