Tracking distributed solar and storage competitive landscapes

Tesla's Powerwall 3 shakes up the residential inverter supplier market

4 minute read

Max Issokson

Research Analyst, US Distributed Solar

Max Issokson

Research Analyst, US Distributed Solar

Max supports research and data collection for our US Distributed Solar practice.

Latest articles by Max

-

Opinion

Tracking distributed solar and storage competitive landscapes

-

Opinion

RE+ 2024: Our 7 biggest takeaways

-

Opinion

The state of US distributed solar-plus-storage

-

Opinion

US distributed solar and storage competitive landscapes shift in 2023

-

Opinion

Which installers and battery vendors top the US distributed solar-plus-storage leaderboard?

-

Opinion

Distributed solar-plus-storage holds much promise, but where does it stand today?

The commercial and community solar segments set annual records for installed capacity in 2024, but the residential segment declined. All segments, however, saw shifting competitive landscapes for installers and equipment manufacturers.

In Wood Mackenzie’s quarterly US Distributed Solar Leaderboard and US Distributed Solar-plus-storage Leaderboard, both available via the US Distributed Solar Service, we rank the top solar installers and equipment suppliers. Read on for an overview of our key findings from 2024.

You can also fill in the form at the top of the page for a complimentary copy of the 17-page executive summary of our US solar market insight 2024 year in review.

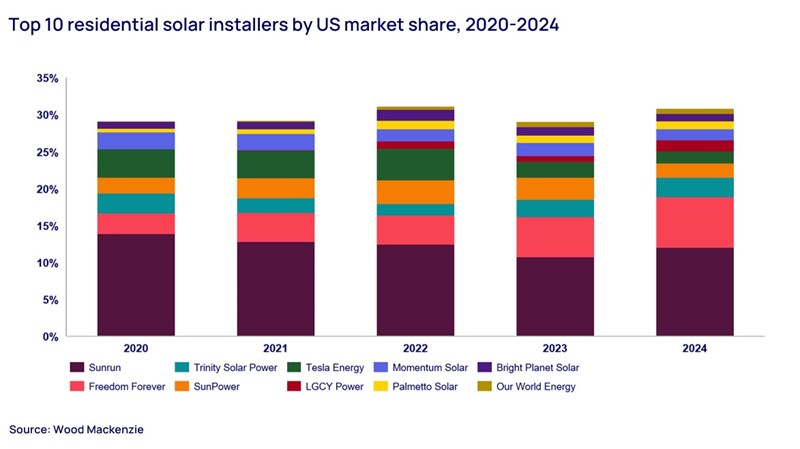

Sunrun and Freedom Forever gain market share amidst a residential solar contraction

Turbulence persisted in the residential solar market in 2024. The segment experienced a 31% decline compared to 2023, marking the lowest year of installed capacity since 2021. Installers faced tough market conditions, with sustained high interest rates, high customer acquisition costs, and cash flow constraints. Two high-profile installer bankruptcies also slowed deployments.

Despite the broader market downturn, Sunrun and Freedom Forever gained market share. The companies held 12% and 7% of the market in 2024, respectively, up from 11% and 5% in 2023. Sunrun's focus on its third-party-ownership subscription model and leadership in energy storage pairing allowed the company to gain market share. Freedom Forever captured market share by expanding its services to new state markets and continuing to focus on providing a premium offering with aggressive pricing.

The new administration and financier instability are driving uncertainty for what’s to come in 2025. Companies that can navigate the changing landscape, optimise their operations, and provide a compelling value proposition to consumers will emerge stronger next year.

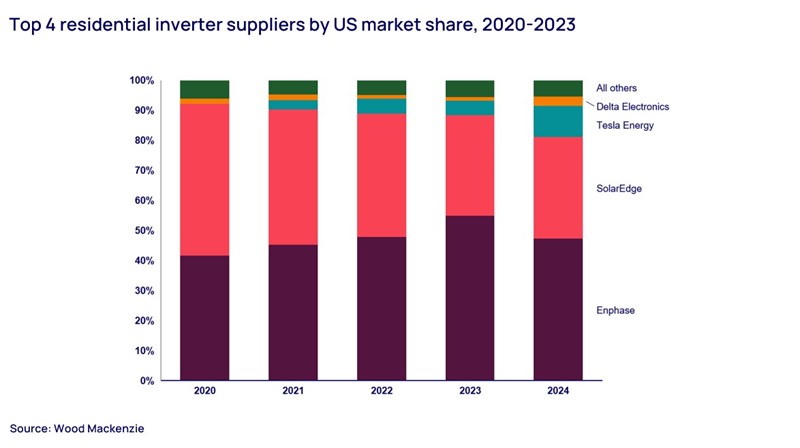

Tesla makes gains in the residential inverter market with Powerwall 3

Enphase and SolarEdge have dominated the residential inverter space for the past several years. Since 2019, the companies have consistently held a combined market share of over 80%. However, their grip on the market is loosening as we enter 2025, with Tesla emerging as a formidable competitor.

Tesla's market presence has grown significantly since launching its first solar inverter in 2021. The company captured 3% of the inverter market in 2021, rising to nearly 5% in 2023. The introduction of Powerwall 3, which features an integrated inverter, has propelled Tesla's market share to 10% in 2024.

The Powerwall 3 has gained market share because of its attractive pricing and ease of installation. Its success also reflects the growing momentum of residential solar-plus-storage. Solar-plus-storage installations grew 44% in 2024, accounting for 28% of residential solar. Wood Mackenzie forecasts the residential attachment rate will reach 35% in 2025.

Tesla's gains have come at the expense of established players. Enphase's market share fell from 55% in 2023 to 47% in 2024. In Q4 2024, Enphase's market share dipped below 40% for the first time since Q2 2020. The SunPower bankruptcy and competition from Powerwall 3 proved to be strong headwinds for the company.

As the solar-plus-storage market grows, we expect storage products with integrated inverters to gain popularity due to their simplified installation process. Enphase and SolarEdge both offer storage products but lack solutions (for now) with integrated inverters that match the Powerwall 3's price point. Enphase and SolarEdge must innovate to maintain their positions in this increasingly competitive landscape.

Nexamp continues to lead the community solar market

Nexamp topped the community solar rankings for the second consecutive year in 2024. The company continued to lead the market by expanding its footprint in key states.

The US community solar market installed a record-breaking 1.7 GWdc of capacity in 2024, a 35% increase from 2023. This growth was primarily led by New York, Maine, and Illinois, accounting for 83% of the national volumes. Nexamp's strategic presence in these states allowed it to capitalise on the growing demand for community solar projects.

Summit Ridge Energy, Standard Solar and Pivot Energy followed Nexamp in the rankings, with market shares of 4%, 4%, and 3% respectively.

Additional findings from the latest Leaderboard include:

- Tesla claimed the top spot in the residential storage supplier market with a 47% market share in 2024.

- Chint Power Systems secured the #1 spot in the 2024 commercial inverter supplier ranking, passing SMA, which ranked #1 in 2022 and 2023.

- In the commercial solar-plus-storage rankings, Pacifico Power led with a 20% market share in 2024 due to strong deployments in California and Massachusetts.

Questions about the US Distributed Solar Leaderboard or the US Distributed Solar-plus-storage Leaderboard? Learn more about Lens Solar here. You can also fill in the form at the top of the page for a complimentary copy of the 17-page executive summary of our US solar market insight 2024 year in review.