The 2025 US power market outlook

We analyse the trends and politics shaping today’s power markets

3 minute read

Chris Seiple

Vice Chairman, Energy Transition and Power & Renewables

Chris Seiple

Vice Chairman, Energy Transition and Power & Renewables

Chris brings more than 30 years of global power industry experience to his role.

Latest articles by Chris

-

Opinion

Energy policy shifts: navigating the One Big Beautiful Bill

-

Opinion

eBook | Navigate power market uncertainty with confidence: the essential guide to profitable energy investments

-

Opinion

eBook | Power surge: can US electricity supply meet rapidly rising demand?

-

Opinion

eBook | Historic opportunities and complex challenges in a volatile world

-

Opinion

The 2025 US power market outlook

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

Ryan Sweezey

Director, North America Power & Renewables

Ryan Sweezey

Director, North America Power & Renewables

Ryan focuses on coverage of North America power markets, producing forecasts of power, capacity and REC prices.

Latest articles by Ryan

-

Opinion

2025 global power market outlook: divergent paths in a transforming energy landscape

-

Opinion

The 2025 US power market outlook

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

North American power markets: navigating a trickier path to decarbonisation

-

Opinion

The Inflation Reduction Act and its impact so far

-

Opinion

The Inflation Reduction Act one year on

At this year’s Infocast Solar + Wind Finance and Investment Summit, our analysts presented a comprehensive outlook on US power markets, highlighting the key forces shaping the sector today and over the next decade.

Read on for a brief summary of the presentation’s key points, or fill in the form at the top of the page to download an extract from the presentation.

2022: A pivotal year for power markets

Wood Mackenzie noted in 2023 the industry had just gone through a remarkable prior year that marked a turning point for global power markets. In both the US and Europe, long-term support for renewables and electrification was put in place. Across the globe it became increasingly evident that extreme weather events were testing the reliability of our electric power systems. The shifting relationship between natural gas prices and demand had introduced new volatility into power markets. On a global scale, the reshaping of trade patterns was making management of supply chains one of the most significant challenges for power sector companies.

2023: Emergence of the demand growth story

The rapid rise in electricity demand, driven largely by data centres and a US manufacturing renaissance, emerged as a key theme in 2023 and quickly became a central topic of conversation in 2024. Hyperscaler US electricity demand has been growing at nearly 23% per year. If the entire cloud industry continues to grow at this capacity, we would see nearly 50 GW of new demand by the end of the decade which, added in proportion to tracked projects, will be difficult to achieve. In July of 2024, Wood Mackenzie had identified about 50 GW of proposed data centres. By January 1st of this year, that number had grown to nearly 100 GW.

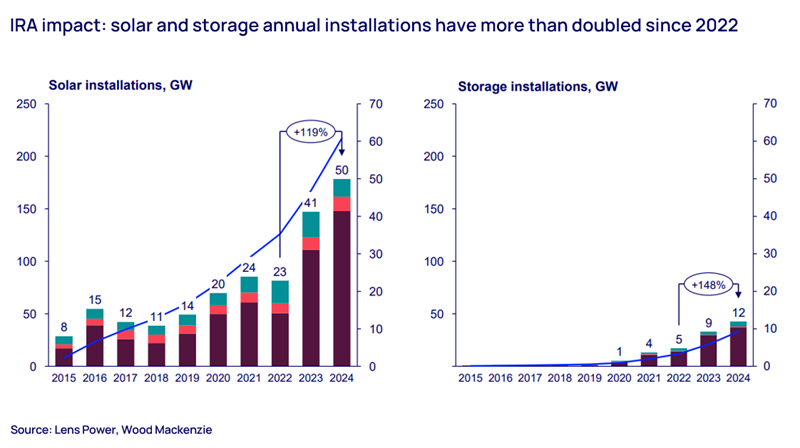

2024: The full impact of the IRA was realised

The Inflation Reduction Act (IRA) has had significant impact on the energy industry already. Solar and storage installations in 2024 were doubled 2022, but this success is under threat. Political uncertainty and policy shifts under a Trump administration have the potential to disrupt the industry. Potential modifications to the IRA could lead to a steep decline in renewable investments causing a reduction of 30% or more. But despite these concerns, buyers are showing a willingness to pay a premium for renewable energy. Continued willingness to pay that premium will be important to the industry as revenue for both solar and wind, if it was forced to compete based on wholesale power prices, declined significantly in 2024 in most markets due to lower gas prices and increased renewables penetration.

Post-election LNG growth

Natural gas has re-emerged as the big winner of the US election. The 2024 election cycle brought a policy shift in support of LNG exports, leading to upward revisions to gas demand forecasts. Both domestic use and North American LNG exports are expected to rise, but what remains is uncertainty over power demand. In 2024, we saw a significant surge in gas turbine orders across North America which led all markets on a global scale. Capacity ordered grew by an incredible 146% - the most since 2015 - and gas turbine orders increased by 36% year-on-year. But gas alone cannot meet the rising electricity demand.

Tackling demand with emerging routes

As demand continues to grow, new approaches for meeting large load demand are gaining momentum. Grid enhancing technologies are leading utility innovation and newer generation options like small modular nuclear reactors, geothermal systems, and carbon capture and storage are getting greater financial support from the tech companies. Behind-the-meter solutions such as temporary fuel cells, gas plants and hybrid plants combining gas with renewables are also growing. But meeting the challenge isn’t just about the technology, policy and regulation will also need to be reshaped to keep pace with demand.

The path forward

The electric industry now sits at the heart of national security, economic growth, and decarbonisation efforts. As pressure to respond to these three priorities grows, so too does the focus on affordability, with rising energy costs becoming a major concern that utilities also have to manage.

The intersection of energy supply scarcity, rising prices, and buyers willing to pay a substantial premium for energy will further reshape the power industry in the coming decade. To keep up, energy policy will need to adapt. As the demand for energy, and particularly clean energy quickly outpaces supply, policy will need to reflect the reality that there is a need for all generation technologies.

Learn more

To download a more detailed extract from the presentation, fill out the form at the top of the page.