Solar surge: the US solar industry shatters records in 2024

But it must now adapt to a new political reality

4 minute read

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë's areas of focus include residential solar policy and project finance

Latest articles by Zoë

-

Opinion

The US solar industry faces a perfect storm of Federal policy and trade challenges

-

Opinion

Insights from Wood Mackenzie’s Solar & Energy Storage Summit 2025

-

Opinion

US residential solar turbulence persisted through 2024

-

Opinion

Solar surge: the US solar industry shatters records in 2024

-

Opinion

US residential solar market turmoil reached new heights this year

-

Opinion

RE+ 2024: Our 7 biggest takeaways

Sylvia Leyva Martinez

Principal Analyst, North America Utility-Scale Solar and Host of Interchange Recharged podcast

Sylvia Leyva Martinez

Principal Analyst, North America Utility-Scale Solar and Host of Interchange Recharged podcast

Sylvia researches market dynamics, business models, market developments and financial strategies of solar PV projects

Latest articles by Sylvia

-

Opinion

The oil and gas majors are phasing down their renewable strategies

-

Opinion

The world’s most-used carbon accounting rule is about to get a major overhaul

-

Opinion

The US solar industry faces a perfect storm of Federal policy and trade challenges

-

Opinion

It’s turbulent times for the wind sector in the US, but the outlook is better across the pond

-

Opinion

US$8 billion in clean energy projects were cancelled this year

-

Opinion

What’s the biggest mistake clean energy developers make when chasing tax equity?

For the first time ever, the US solar industry installed nearly 50 (49.99) GWdc of capacity in 2024, a remarkable 21% increase from 2023. The industry continued breaking records and experiencing unprecedented growth, accounting for 66% of all new generating capacity added in 2024. All solar segments set annual installation records except for residential solar, which experienced its lowest year of new capacity since 2021.

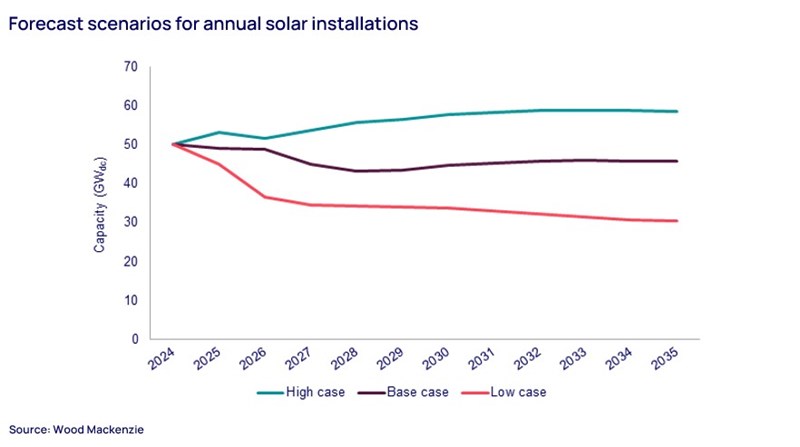

However, the new administration brings significant uncertainty to the US solar industry, with policy, economic, and supply chain factors in flux. In our US solar market insight 2024 Year in review report, created in collaboration with the Solar Energy Industries Association (SEIA), we forecast a High and Low case scenario in addition to our Base case to help navigate this uncertainty.

Fill in the form at the top of the page for a complimentary copy of the 17-page executive summary. Or read on for some key highlights.

The US solar industry capacity will more than triple over the next decade in our Base case

2024 was the year of the materialisation of the Inflation Reduction Act (IRA). Solar installations more than doubled in 2024 compared to 2022. Supply chains have become more resilient. Interest from utility and corporate offtakers is soaring. However, we expect 2025 installations to remain similar to 2024 as policy uncertainty partially offsets high demand. In 2024, solar module manufacturing capacity also made great strides, rising to 40 GW of capacity, nearly six times higher than the capacity that existed in 2022.

Although President Trump has already issued multiple executive orders within the first few weeks in office, including actions on federal funding and tariffs, it has not resulted in material changes to our forecast. In our Base case outlook, the US solar industry will add more than 375 GWdc by 2035. Over the next decade, cumulative solar installations will exceed 730 GWdc, compared to 236 GWdc installed as of year-end 2024. However, after the significant growth that occurred in 2023 and 2024, challenges related to interconnection delays and labor availability will constrain future solar development. Plus, market penetration continues to reach higher levels in many states. Overall, this contributes to our expectations of a 1% average contraction in annual installations over the next 10 years.

A High case in which the tax credits remain in place with no changes, financing availability increases, and solar product supply availability remains high would increase our outlook by 24%

In our High case, tax credits within the IRA remain unchanged, and any pending guidance is released expeditiously and generally favorable for developers. The ITC bonus adders, such as the energy communities, domestic content and low-income community adders, remain at full value.

On the financing front, tax equity availability increases faster than anticipated as more corporate players participate in the transferability market, increasing the financing available for renewable energy projects. We assume that interest rates decline at a faster pace than in our Base case, bringing down the cost of capital more quickly. In this scenario, availability of solar product supply is high.

Our High case results in a 24% increase in total solar installations through 2034 relative to the Base case, translating to an additional 118 GWdc of capacity.

A Low case in which tax credits phase out early, the transferability market declines, and supply chain constraints increase would decrease the outlook by 25%

Our low case scenario presents a more challenging environment for the US solar industry and is directionally opposite to our High case.

In the low case, we see an early phase-out of the ITC, while the PTC is reduced to 80% of its original value in the near-term. All bonus ITC adders and direct pay provisions are eliminated early in the forecast period. These measures have a significant impact on project economics, particularly for tax-exempt entities.

We assume that tax equity availability struggles to keep up with demand as the tax basis decreases with the corporate tax rate reductions, limiting available financing for renewable projects. The transferability market also faces challenges, further constraining financing options. Interest rates remain at their current levels through our outlook, resulting in a sustained high cost of capital and weaker project economics.

The Low case also assumes solar product supply is more limited, which is driven by decreases in the imported solar product supply chain and more modest solar product domestic manufacturing buildout.

Our alternative scenarios show that, based on various policy decisions and economic outcomes, there could be nearly a 250 GWdc swing in solar installations over the next decade.

Learn more

The full report explores each segment in detail and delves into the assumptions used for each forecast scenario. Fill in the form at the top of the page for a complimentary copy of the 17-page executive summary.