Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

As the oil & gas industry negotiates turbulent times, we look at two regions taking very different approaches

4 minute read

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Global upstream update: diverging development strategies in Latin America, investment at risk in Africa, and Kazakhstan supply tensions explained

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

Global economic and oil price-related volatility in recent weeks has sent shock waves through the up-stream industry. You can read the latest analysis of tariff-related impacts on the oil & gas sector here.

The oil and gas industry is experienced at uncertainty, but there are many different approaches. Some governments will continue to eagerly court new explorers, others will look to maximise economic rent on existing assets without incentivising new investment.

Our latest Global upstream update gathers the latest industry insight on the topics that matter from our expert regional analysts. In addition to looking at how low prices would have to fall before investment and supply would be impacted, it covers the UK government’s consultation on a post-2030 price-shock mechanism and the 100+ new licence opportunities across Asia.

Fill out the form to access a complimentary extract from the report, or read on for a taste of the hot topics covered.

Asia Pacific: upstream licences galore

Asia-Pacific is very much open for new upstream business in 2025, with over 100 new blocks on offer in rounds across the region, from onshore to deepwater, mature to frontier.

The Pakistani government has announced the release of 40 offshore and 31 onshore blocks, with improved terms and gas prices to tempt investors. To date, just 14 exploration and appraisal (E&A) wells have been drilled in Pakistan’s offshore Indus basin, the last unsuccessfully by Eni in 2019. However, the area has one of the world’s largest delta fans, with sediment beds up to 10 kilometres thick.

Meanwhile, India’s latest release comprises 25 blocks totalling 191,986 square kilometres across 13 ba-sins. That makes it the largest offer in the history of India’s Open Acreage Licensing Policy (OALP). The Indian government has also moved to improve and stabilise the country’s regulatory environment through enhanced incentives, easier access to seismic data and amendments to its Oilfields (Regulation and Development) Act (ORDA).

On a much smaller scale, Brunei has announced a two-block offshore round, with bids due towards the end of 2025. Few specific details on the prospects in the two blocks (A and D) or on fiscal terms have been released, other than that the latter will be ‘flexible’.

Separately, Vietnam has launched a three-block licensing round, its first in 13 years.

Spotlight on Malaysia

Malaysia’s 2024 licencing round saw wins for both the Majors and smaller players. Three exploration Production Sharing Contracts (PSCs) were awarded, along with 11 discovered resource opportunities (DROs) and two technical evaluation agreements (TEAs).

New entrants Eni and BP both signed TEAs for the frontier Langkasuka and Layang-Layang basins, alongside INPEX, PETRONAS Carigali, Pertamina, PTTEP and TotalEnergies. These are similar to joint study agreements, with minimal work commitments that offer a low-risk entry strategy.

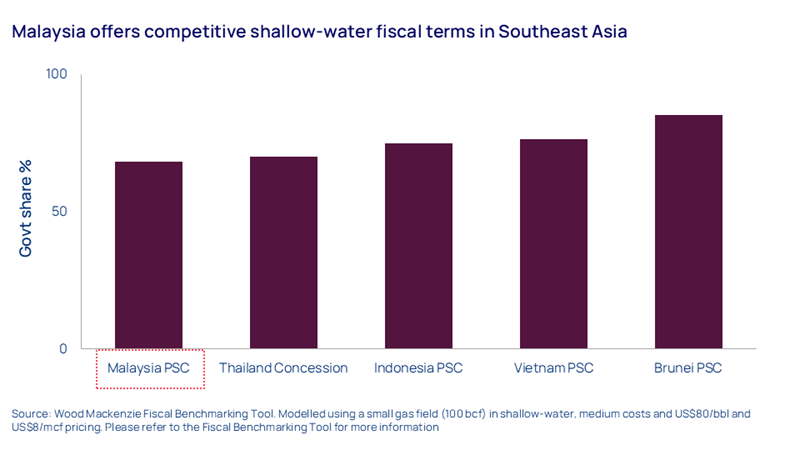

Nearly 300 million barrels of oil equivalent remain undeveloped in Malaysia’s small fields. The govern-ment’s small field/DRO fiscal terms have proved popular since their introduction in 2021, and thanks to tweaks including simplified contract models, interest in marginal fields remains strong. The 11 DROs awarded bring the total to date to 14. As well as regional players Jadestone and Hibiscus, winners include EnQuest, Ping and Seascape, all players who have turned their focus towards Asia due to increasing tax risks in the UK North Sea.

However, oil price volatility will cause concern, as many marginal projects will be in danger of being delayed or shelved if oil prices stay lower for longer.

Europe: a pivotal year for the UK

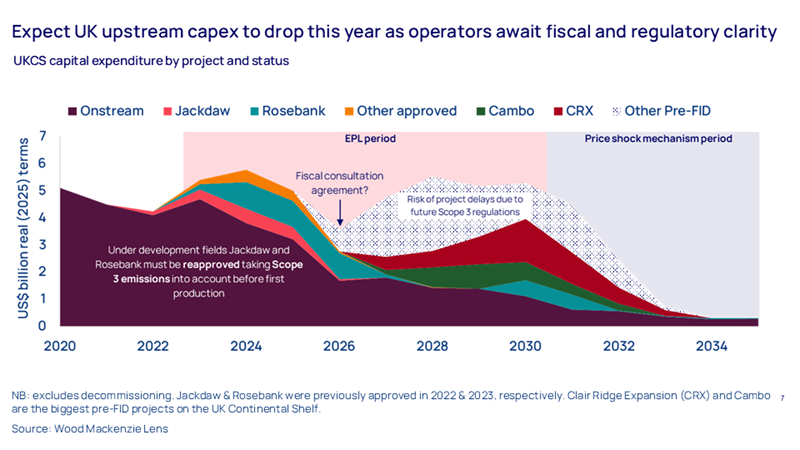

In Europe, fiscal changes could lead to a more negative upstream outcome than we are seeing in Asia. The UK government has begun a 12-week consultation on a new post-2030 price-shock mechanism. After a delayed start, time is tight – once the consultation closes on 28 May, an initial proposal will be followed by industry engagement in Q3, with a final proposal to be announced ahead of the Autumn budget.

With UK upstream capex dipping as operators await clarity on the future fiscal and regulatory regime – particularly as regards the treatment of new investments – the stakes are high. We estimate a successful and timely outcome could unlock US$33 billion of investment starting from 2026, with 64% of that coming from projects that have yet to receive a final investment decision.

However, a period of oil price and geopolitical uncertainty could change the tone, and once again the UK government will have to consider if it has the right fiscal balance and incentives across different price bands.

The consultation covers three regulatory areas: defining price thresholds; design (revenue or profit based, or a mix of both); and the basin opportunity set. The government prefers a revenue-based mechanism, which would form part of a permanent regime alongside Ring Fence Corporation Tax, Supplementary Charge and Petroleum Revenue Tax. The tax rate of the mechanism, which is not being consulted on, will depend on the final design and price threshold.

Don’t forget to fill in the form at the top of the page to receive your complimentary extract from the report. This covers further hot topics, including risks to Venezuela’s oil recovery, ongoing high levels of Russian exploration and appraisal and the threat to Kazakh oil exports from drone attacks.