Sign up today to get the best of our expert insight in your inbox.

What a future Ukraine peace deal means for energy (Part 2)

A windfall for Russian oil producers and impetus for upstream investment

4 minute read

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

Opinion

Oil and refined products in H2 2025: a commodity trader’s guide

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Oil and refining market implications of Israel’s strike on Iran

-

Opinion

What is the impact of US tariffs on oil and refining?

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

US Lower 48 upstream: the US Majors’ long-term strategic advantage

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

Emma McRae

Research Analyst, Global Oil Supply

Emma McRae

Research Analyst, Global Oil Supply

Emma develops long and short-term liquid supply outlooks, mainly focusing on Europe and Africa.

Latest articles by Emma

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

Opinion

Libya: the two-million-barrel question

Michael Moynihan

Research Director, Russia Upstream Oil and Gas

Michael Moynihan

Research Director, Russia Upstream Oil and Gas

As a research director in our upstream team, Michael analyses developments in the upstream industry in Russia.

Latest articles by Michael

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

Opinion

Russian Federation upstream: 4 things to look for in 2024

-

Opinion

Global upstream update: a review of key industry themes

The implications of a future Ukraine peace deal matter for the oil market, albeit less momentous than those we scoped out for gas and LNG last week. Lifting sanctions will unleash limited new supply but could bring billions of dollars of revenues immediately to the Russian industry and in time lead to higher investment in upstream.

Alan Gelder, Emma McRae and Michael Moynihan shared their thoughts with me.

First, Russia’s liquids production has barely missed a beat

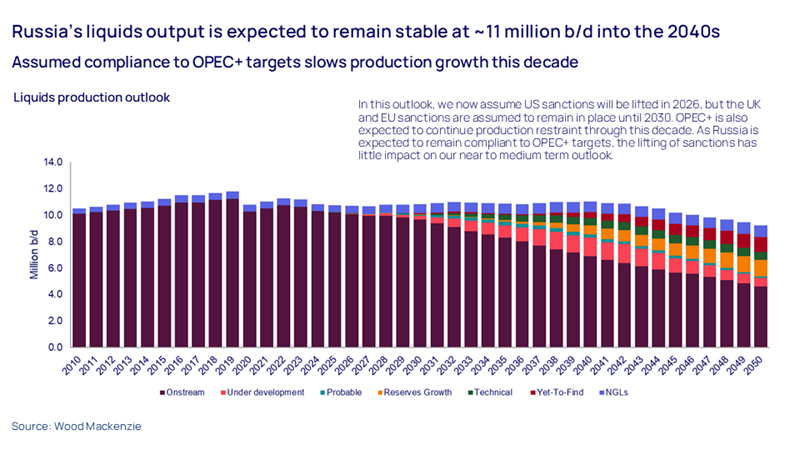

Output averaged 10.85 million b/d in 2024, just 4% lower than the invasion year of 2022 when it reached 11.28 million b/d. The modest reduction essentially reflects Russia’s compliance with its OPEC+ obligations.

Despite EU and US sanctions, Russian exports have, by hook or by crook, made their way onto the global oil market. Crude and condensate exports have held steady over the last three years at around 3 million b/d, though sanctions have forced barrels away from traditional export markets in Europe and the US to more distant refiners in Asia.

Waterborne crude exports via ESPO (Eastern Siberia Pacific Ocean pipeline) to Asia have consistently averaged around 0.8 million b/d, mostly landed in China. ESPO volumes surpassed 1 million b/d at the beginning of this month.

Russia has used every trick in the book to get around sanctions on its waterborne exports, including spoofing tanker GPS coordinates, disabling transponders, conducting ship-to-ship transfers to non-sanctioned vessels, flag-hopping and using shell companies to conceal ownership details. Volumes of Urals, which dominate waterborne crude exports, have held firm since the war began at around 1.5 million b/d, most of which is shipped through the Suez Canal and landed in the Indian sub-continent.

With production resilient and exports continuing to find a way to market, lifting sanctions won’t lead to much, if any, additional supply to the global oil market in the short term.

Second, Russian exporters could still gain substantial economic value from the lifting of sanctions

Freight costs to India are more expensive, plus there’s been a loss of value from the G7’s US$60/bbl price ceiling imposed in December 2022. The ceiling was imposed on crude exports transported in tankers insured by G7 countries, and the loss is despite Russia using a huge shadow fleet and older vessels registered and insured elsewhere.

The combined effect is that the waterborne value (FOB) of Urals exports delivered to the Indian sub-continent are reported to be US$15-20/bbl below Brent (FOB) compared to levels of US$2-4/bbl pre-2022 that primarily reflected quality differences.

Russian oil producers could be in for a revenue uplift worth US$6 billion a year on our calculations if sanctions are lifted due to the narrowing of the discount to Brent, equivalent to a 10% increase in export volumes.

Third, there’s the prospect of higher investment in Russian upstream

An idea floated by the Russian side at the recent discussions between the US and Russia in Riyadh was investment opportunities in the Russian Arctic, though it’s unclear whether the dangle was for the offshore or onshore. Offshore exploration in the Russian Arctic is still prohibitively expensive, technologically challenging and production upside long dated.

Russia’s primary focus will be on re-invigorating Rosneft’s flagship 2 million b/d onshore Vostok Oil project. IOCs have the technology skills to accelerate development but are unlikely to have altered their views on participating in the project given they were lukewarm even before the invasion of Ukraine.

The outlook for the project would, however, undoubtedly improve as technology transfer, service provision, shipping solutions, finance and a more diverse range of export markets reappear should sanctions be lifted.

Finally, how would lifting sanctions affect oil prices?

Based on the dynamics of negotiations which are still at an early stage, a peace deal effectively forced on Ukraine by the US and Russia looks the likely outcome. This would widen the difference in the US and European approaches to Russia. In our analysis, we assume US sanctions will be lifted in 2026, but EU and UK sanctions are assumed to remain in place until 2030.

We currently expect Brent to average US$73/bbl in 2025, 10% below last year with the market unnerved by the dual announcements in recent weeks of US tariffs threatening demand growth and confirmation by OPEC+ of its plan to ease production restraint from April.

Lifting sanctions on Russia won’t add to supply and the fundamentals will remain unchanged, though it would remove one of the sources of geopolitical tension supporting price. However, the end of the Hamas-Israel ceasefire may offset any negative sentiment in the market from Russian sanctions being lifted – and delay the Trump Administration’s goal to reduce oil prices.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.