Sign up today to get the best of our expert insight in your inbox.

Big Mining pivots to copper for growth

Is the era of capital discipline over?

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

NOCs begin a new phase of upstream internationalisation

-

The Edge

How AI can unlock an extra trillion barrels of oil

-

The Edge

How data centre growth is driving up US power prices

-

Opinion

CCU – from decarbonisation to defossilisation

-

The Edge

Securing offtake for green hydrogen

-

The Edge

Gastech 2025: when will the music stop for US LNG?

James Whiteside

Director, Head of Corporate Research - Metals & Mining

James Whiteside

Director, Head of Corporate Research - Metals & Mining

With 15 years of experience in the metals and mining industry, James leads our corperate coverage.

Latest articles by James

-

Opinion

The end of capital discipline in mining?

-

The Edge

Big Mining pivots to copper for growth

-

Featured

Metals & mining 2025 outlook

-

Opinion

Battery power play: countercyclical opportunities in raw materials

-

Opinion

Copper rush: A strategic analysis

-

Opinion

PPAs: transforming miners’ decarbonisation strategies

Metals and mining companies are starting to shake off the sector’s long-held dedication to capital discipline. In stark contrast to Big Oil corporates which are cutting budgets, Big Mining are upping investment with the goal of growing mine supply. James Whiteside, Head of Metals and Mining Research, analysed the future capital allocation strategies of thirteen of the biggest Diversified Miners and copper producers. I asked him what’s behind the change in tack.

How much more are miners spending?

The thirteen companies have flagged an increase in 2025 averaging almost 10%. This will lift spend for the peer group to a combined US$60 billion in 2025, just under half of the total across the entire metals and mining sector. What’s interesting is that the increase comes after an extended period of capital discipline and contrasts with the rest of the global sector. We forecast at the start of the year that overall spend in mining would fall by 10% to 15% driven by a continued fall in investment in steel, iron ore and coal.

Why are the Big Miners’ going against the trend?

It’s mostly about copper. Copper prices are well supported in 2025 by perky demand while new mine supply is lagging. But companies are increasingly confident beyond 2025, with the bullish outlook for power demand one emerging factor. Rising investment in transmission and distribution to connect the booming datacenter sector promises a new and sustained driver for additional investment in copper supply over the next few years.

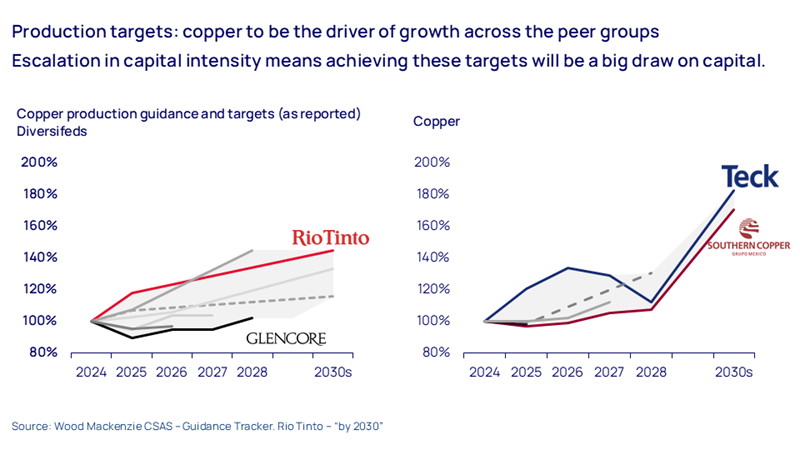

Copper producers are setting their sights on lifting supply in the medium term. Teck and Southern Copper are among the boldest, both aiming to increase production by 70% to 80% by the early 2030s.

Copper is also the focus of growth for Diversified Miners, which face stagnating cash flows on the back of weaker iron ore demand from China and soft prices. They are pivoting to invest organically in copper and acquiring additional exposure to copper via M&A. Deals have totalled US$20 billion over the last three years and we expect to see more copper-led M&A.

Are we seeing the end of capital discipline?

Miners have spent the best part of a decade assiduously rebuilding finances after the excesses of the last upcycle. Balance sheets are now in pretty good shape and management won’t give that up easily.

Capital discipline has also become synonymous with maximising shareholder returns at the expense of capex. Any surplus cash flow not used to pay down debt has gone back to shareholders, but there are now signs investors are willing to sacrifice payouts in return for growth in the right commodities.

Greenfield copper projects are starting to offer the most attractive returns for capital deployment. However, not every mining company has a pipeline of growth opportunities.

Moreover, investment in supply is not the only call on cash flow. Companies need to increase spend on decarbonisation to hit interim 2030 targets and maintenance capex requirements are growing as mines deteriorate.

Gearing levels for the Diversified Miners and copper producers have converged to a range of 20% to 25% which we think represents a ‘new norm’. Companies will continue to prioritise robust balance sheets, but recent moves in M&A suggest mining companies are prepared to use the balance sheet to access the right growth opportunities.

Will investors back the pivot to growth?

So long as investment is justified by the fundamentals, is measured and targeted. But investors will be wary, mindful of miners’ past tendency of being their own worst enemy by over-investing and bringing too much supply into the market.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.