Get Ed Crooks' Energy Pulse in your inbox every week

US E&Ps look for international growth

A projected plateau for US oil production starting in the early 2030s is driving a revival of interest in assets around the world

10 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Keeping cleantech investment alive

-

Opinion

Can energy close US trade gaps?

-

Opinion

Tariff shockwaves shake the energy industry

-

Opinion

How can the power industry meet the challenge of rising demand?

-

Opinion

Is the US being left behind in the race to develop new clean energy technologies?

-

Opinion

US E&Ps look for international growth

"Time is a flat circle,” a character says in the TV series True Detective. “Everything we've ever done or will do, we're going to do over and over and over and over again, forever.” Corporate strategies can often feel like that.

As today’s plans face challenges, companies look for new thinking. And often that means looking at old ideas that were rejected in the past, to see if they can be useful for the future.

We are seeing exactly that cycle in the US E&P industry at the moment, with the revival of interest in international operations. In the 1990s and through into the 2000s, many US E&Ps had active international businesses, in the Middle East, Europe, Africa and South America.

But after the start of the US tight oil boom around 2011, American E&Ps moved to shed their foreign assets. Outside Argentina’s Vaca Muerta, those businesses were scaled back entirely.

Investors no longer saw international diversification as an advantage: they wanted to maximise their exposure to the exciting prospects of the US tight oil industry. And they believed that US companies would perform better if they focused on their domestic resource base, rather than trying to spread themselves across a scattered range of assets around the world.

Now we are starting to see the pendulum swing back again. US E&Ps have started making moves to strengthen their international operations. They aim to bring their expertise in shale gas and tight oil, which has brought them spectacular success in the US, to other unconventional resources around the world.

EOG Resources last month signed an agreement with Bapco Energies of Bahrain to work together on evaluating a promising gas exploration prospect in the kingdom.

And this month Continental Resources signed a joint venture deal with TransAtlantic Petroleum and the Turkish national oil company TPAO to develop shale oil and gas fields in Türkiye.

Other US E&Ps are also looking at possible international expansion, but have not yet reached the stage of agreeing any deals.

It is too early to say that we are at the start of a complete strategic U-turn for the US oil and gas industry. But the revival of interest in international deals does mark a break with the prevailing trends of the past 10 years, and a possible return to earlier strategic models for US E&Ps. And there are reasons to think that other companies may follow the course that EOG and Continental have set.

The Wood Mackenzie view

EOG and Continental have company-specific reasons for being among the leaders in the upsurge of interest in international exploration, says Josh Dixon, a Wood Mackenzie senior research analyst for Upstream.

EOG has been the subject of commentary about the strength of its resource base. Mizuho this week reportedly cut its price target for the shares, in part because of concerns about the “depth and quality of EOG’s remaining shale inventory”.

EOG has some international operations, with production in Trinidad. But that accounted for just 4% of its total output last year. Success in international development would be a way to ease concerns about its inventory and build another valuable long-term business.

Meanwhile Harold Hamm, founder and chairman of Continental, has been focused on the challenges of producing oil in the US. “There’s a lot of fields that are getting to the point that’s real tough to keep that cost of supply down,” he told Bloomberg TV recently. “When you get down to that $50 oil… then you’re below the point where you’re going to ‘drill, baby, drill’.”

Beyond those two companies, there are others that are looking at the long-term outlook for US oil production and wondering if they will need to invest internationally to find growth – or even to maintain production – in the 2030s.

Wood Mackenzie’s forecasts show US oil production reaching a high point in 2031 and then starting to decline. It is more of a plateau than a peak: over the ten years to 2041, we expect total liquids production to fall by only about 3 million barrels per day, or about 10%.

But even that slow decline in total production will make it difficult for individual companies to deliver growth.

Expectations that oil and gas demand will remain robust for decades are sharpening interest in long-term supply. The lack of progress in international climate negotiations, and President Donald Trump’s decision to withdraw the US from the Paris agreement, have underlined the fact that the world is not close to the pathway of declining oil and gas demand that would be required to reach net zero greenhouse gas emissions by 2050.

In a world of “stronger for longer” oil and gas demand, the industry would need significantly higher investment. Companies may need new strategies.

US oil and gas production has frequently surprised to the upside in the past, and could do so again. But increased international activity from US companies, using their expertise in shale oil and gas to unlock resources in other countries, could make an important contribution to meeting higher demand.

We think there is a good chance that more international deals for US E&Ps could be announced soon.

Dallas Fed survey highlights US oil and gas industry concerns

The Federal Reserve Bank of Dallas conducts a quarterly survey of about 200 Upstream and oilfield services companies in Texas, New Mexico and Louisiana, which provides a useful snapshot of opinion in the industry.

The latest survey, published this week, showed broadly positive conditions in the sector, but a significant deterioration in views of the outlook, and a leap in uncertainty. The comments section of the survey, which allows respondents to volunteer views on any issues affecting their businesses, points to a major source of that uncertainty: the policies of the Trump administration.

The respondent’s concerns centre around two issues: the administration’s push to drive down the cost of energy for consumers, and the increased tariffs intended to encourage investment in key manufacturing sectors such as steel. In the words of one commenter: “I have never felt more uncertainty about our business in my entire 40-plus-year career.”

“The administration's chaos is a disaster for the commodity markets,” another comment says. “‘Drill, baby, drill’ is nothing short of a myth and populist rallying cry.” Another adds: “The threat of $50 oil prices by the administration has caused our firm to reduce its 2025 and 2026 capital expenditures. ‘Drill, baby, drill’ does not work with $50 per barrel oil.”

On the increased tariffs, one respondent says: “Planning for new development is extremely difficult right now due to the uncertainty around steel-based products.” Another adds: “Global geopolitical unrest and the uncertain economic outcomes of the administration’s tariff policies suggest the need to hit the pause button on spending.”

Chris Wright, the energy secretary, is well-known and widely admired in the US oil and gas industry. Before entering government, he ran the oilfield services company Liberty Energy. As some of the commenters in the Dallas Fed acknowledge, many in the industry have welcomed the Trump administration’s rejection of climate policy, and its moves to reduce the regulatory burden on companies and expedite key projects.

However, Wright has made clear that President Trump’s priorities are to cut costs for consumers and rebuild US manufacturing, not to help the oil and gas industry.

“He’s a negotiator, he’s a businessman. He got elected to lower prices for American consumers,” Wright told Bloomberg TV earlier this month.

“You think he’s going to change his mind and say ‘No, I’m in favor of higher prices on American consumers’? That’s not where this administration is going.”

In brief

The Trump administration has stepped up US pressure on Venezuela, announcing a new 25% tariff on imports from any country that buys Venezuelan oil, whether directly or indirectly. The administration said the tariffs were necessary because President Nicolás Maduro’s government posed “an unusual and extraordinary threat” to the national security and foreign policy of the US. The new tariffs will take effect from 2 April. Reports have suggested that activity at Venezuela’s oil ports has already slowed.

Meanwhile, Chevron has been given more time to wind down its operations in Venezuela. Its new deadline is 27 May.

Germany could restart six of its shut-down nuclear reactors by 2030, an industry group has said. Rising energy costs and concerns about national security have led to a reappraisal of the role of nuclear power in the country, which shut down its last reactors two years ago.

The climate protest group Just Stop Oil has said it is ending its campaign of direct action, which has included road-blocks and attacks on paintings in art galleries. The group said its demand to end new oil and gas development in the UK was now government policy, “making us one of the most successful civil resistance campaigns in recent history”, but it was now time to change its tactics.

Recent legislation in the UK has increased the penalties has increased the penalties for the group’s activities, and dozens of its supporters have been jailed. Sources said any new protest movement created to succeed Just Stop Oil would have a new name and a new strategy.

The UK government has said that development at the Rosebank and Jackdaw fields, which have been the subject of legal battles over their climate impacts, will be allowed to proceed. The Court of Session in Edinburgh ruled in January that the government had not adequately assessed the expected climate impacts of the oil and gas produced from the fields, and ordered it to reconsider its decision to approve the projects.

The government has not formally announced the new approvals, but has made it clear that it will allow the projects to go ahead. Both fields will be managed by the new joint venture formed from the merger of the UK offshore interests of Equinor and Shell, once that deal is completed.

Other views

(Part 1 is here)

Subsea sabotage puts European power at risk – Elisabeth Braw

How to liberate electric power – Devin Hartman

Quote of the week

“There was no lack of capacity from the substations… Each substation individually can provide enough power to Heathrow… Two substations were always available for the distribution network companies and Heathrow to take power.”

John Pettigrew, chief executive of National Grid, told the Financial Times that the loss of electricitythat shut down Heathrow airport for most of a day last week happened even though the local transmission network remained capable of supplying sufficient power to keep the airport open.

Heathrow’s management replied that it would not have been possible for Heathrow to keep operating following the transformer fire that closed the critical substation serving the airport.

Chart of the week

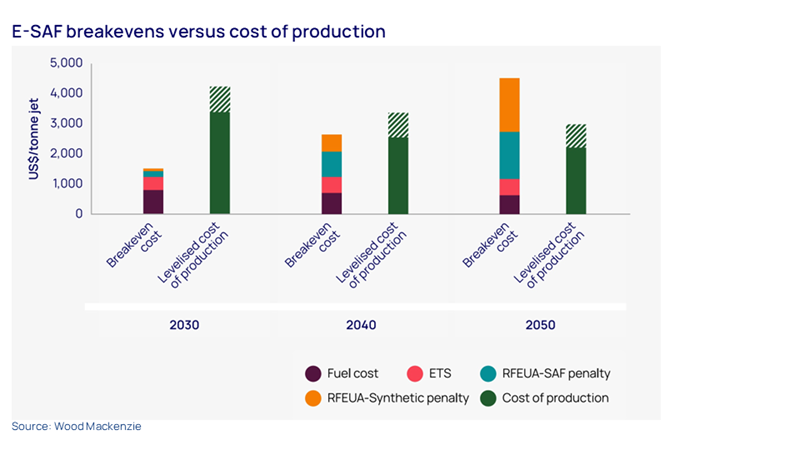

This comes from a new Wood Mackenzie e-book: Investing in hydrogen from now to 2050: what you need to know. The hype over low-carbon hydrogen has cooled sharply over the past year, and many projects have been delayed or canceled. However, hydrogen still has a key role to play in a decarbonised economy. Some segments of the hydrogen industry can still have an attractive long-term future. But success or failure is going to be determined on a project-by-project basis.

This chart shows the outlook for prices of Sustainable Aviation Fuel (SAF) made from low-carbon hydrogen. By 2040, we think some e-SAF projects can be competitive with conventional jet fuel in Europe, including carbon prices and costs under ReFuelEU Aviation (RFEUA) regulations. Download the whole report for more of Wood Mackenzie’s views on the hydrogen industry outlook, and an introduction to our detailed granular data in Lens Hydrogen.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.