Get Ed Crooks' Energy Pulse in your inbox every week

Ceasefire in the Israel-Iran conflict

As the threat of supply disruption fades, risk premiums in oil and gas prices have fallen

8 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

What the "big beautiful bill" means for US energy

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

The hostilities between Israel and Iran, and the US intervention in that conflict, escalated rapidly this month with little warning. They now appear to have de-escalated just as quickly.

By Monday afternoon, less than 48 hours after US aircraft and missiles hit three Iranian nuclear sites, President Donald Trump was congratulating Israel and Iran on having agreed a ceasefire. There was a further exchange of air and missile strikes before the truce took effect, but since then, the ceasefire appears to have been holding.

As a result, the risk premium in oil and gas prices, based on possible disruption to traffic passing through the Strait of Hormuz, faded quickly.

Brent crude peaked at over US$80 a barrel soon after markets opened in Asia on Monday morning. By Tuesday, it was down to about US$67 a barrel – close to its level before Israel began its strikes against Iran on 13 June.

Gas prices showed similar movement. European benchmark TTF gas for delivery in the third quarter peaked last week at the equivalent of about US$14.40/mmbtu. By Tuesday of this week, it was trading at about US$12.30/mmbtu, down about 14%.

There were initially mixed reports about the success of the US attacks. But by Thursday, the consensus view – backed by the CIA and the Israel Atomic Energy Commission, among others – was that Iran’s capacity to enrich uranium had been severely damaged, and its nuclear programme had been set back by years.

As soon as the ceasefire was announced, President Trump started adopting a conciliatory tone in his statements on Iran. He even suggested that the international sanctions that restrict its oil exports could be eased.

“They are going to need money to put that country back into shape. We want to see that happen,” he told a news conference at the NATO summit in The Hague.

The US has restarted talks with Iran over a permanent agreement that would stop the Iranian government from pursuing a nuclear weapons programme in the future. Trump administration officials have even discussed the possibility of the US helping Iran develop its civil nuclear programme as part of that deal.

Steve Witkoff, the US Special Envoy to the Middle East, told Fox News: “Now it’s time for us to sit down with the Iranians and get to a comprehensive peace deal, and I’m very confident that we’re going to achieve that.”

With Iran moving towards a deal with the US – and perhaps eventually increasing its oil exports – the outlook for global energy markets today looks very different from how it appeared last weekend. But given that the situation has already delivered several significant surprises just over the past month, the possibility of further shocks in the future cannot be ruled out.

The Wood Mackenzie view

If the ceasefire holds, the fundamentals of the global oil market will regain their influence on prices, Wood Mackenzie analysts say. Before Israel launched its attacks on Iran on 12 June, the market was heading for oversupply by the fourth quarter of this year.

The eight OPEC+ member states that last year announced a 2.2 million barrels per day voluntary production cut have been unwinding that cut since April. Ann-Louise Hittle, Wood Mackenzie’s head of Macro Oils, says that if they continue to bring production back at the pace they have set so far, that cut would be completely unwound by October.

With global oil demand growth sluggish as the world economy faces headwinds, that would lead to a well-supplied market and downward pressure on prices before the end of the year.

Iran is not expected to be an additional source of increased oil supply for world markets, for the time being. Unless and until the US makes official statements on sanctions being lifted, we would not expect Iran’s production to rise further than our current estimate of roughly 3.5 million b/d.

However, if and when international sanctions are lifted, perhaps as part of a deal over Iran’s nuclear programme, it may be able to increase exports further

For gas, meanwhile, the market is expected to remain relatively tight this year, says Massimo Di Odoardo, Wood Mackenzie’s vice president of Gas and LNG. Europe needs to rebuild stocks following a cold winter. And after the end of the transit agreement with Ukraine last year, it also has less Russian supply. Asian LNG demand has been weak throughout the first and second quarters of this year, but could pick up in the fourth quarter if there is a return to more normal weather after the relatively warm winter of 2024-25.

Looking ahead to 2026, however, the market is braced to absorb substantial LNG supply growth, driving down prices as sellers seek additional demand, particularly in Asia.

If peace lasts in the Middle East, buyers and sellers will increasingly focus on the other big risk in the market. That is, the possibility that a continuation of the war in Ukraine will result in the EU legislating to ban Russian LNG imports and flows through TurkStream, the last pipeline route for Russian gas to Europe.

But it is also possible that a peace agreement between Russia and Ukraine could allow for some return of Russian pipeline gas flows to the EU.

The decline in oil prices means that – at least for the time being – a threat to the global economy has been removed. Peter Martin, Wood Mackenzie’s head of economics, says higher prices had intensified the downside risk to Wood Mackenzie’s forecast for world GDP growth of 2.4% for 2025, which was already a reduction from 2.8% growth in 2024.

If Brent crude averaged US$76 a barrel through to the end of the year, we would cut our forecast for global GDP growth in 2025 to 2.2%. It would also increase the estimated risk of a global recession from a 20% chance to a 30% to 40% chance.

Fears of inflation would also grow, leading to slower reductions in interest rates and perhaps increases from some central banks.

If supply disruption pushed oil prices to US$100 a barrel, we would expect global economic growth to slow even further to 2% this year, and the recession risk to rise in the range of 60% to 80%.

Along with its other benefits, a lasting peace agreement in the Middle East would defuse that threat to the world economy. There are other looming risks for global growth, not least the Trump administration’s “reciprocal” tariffs on US trading partners, which are currently suspended pending the results of negotiations over new trade deals. The 90-day pause on implementing those tariffs is set to expire on 9 July. But the threat a commodity price shock triggering a global downturn has clearly receded, for the time being at least.

In brief

Power grids in many parts of the US have been straining to meet demand as “heat dome” conditions led to sweltering temperatures across much of the country. The regional transmission operators PJM and MISO issued grid alerts, and wholesale electricity prices soared in some markets. The Department of Energy issued an order allowing power plants in North and South Carolina to keep running, even if they breach emissions limits, to prevent blackouts.

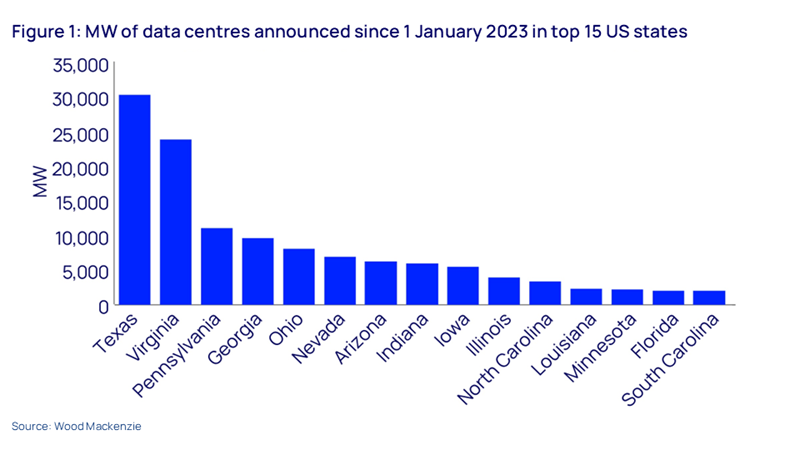

The state government of Texas has passed legislation intended to reduce the risk of blackouts as demand on the ERCOT grid surges. The new law, known as SB6, compels large loads such as data centres to accept mandatory curtailment at times when the reliability of the grid is threatened. Wood Mackenzie data show that Texas is the leading state in the US for planned development of new data centres, fueling concerns about growing strain on the grid.

New York state, which shut down one of its nuclear plants in 2021, earlier than originally planned, now plans to build its first new reactor in a generation. Kathy Hochul, the state’s governor, announced that she had directed the New York Power Authority to develop and build a new nuclear power plant to support the reliability of the grid with increased zero-emissions electricity supply. Hochul said she wanted “an energy policy of abundance” that would attract manufacturers to invest in New York.

Other views

Power struggle: challenging grid conditions for SPP – Madelyn Skinner and Zak Vinter

The US energy storage market continues strong growth in Q1 2025

4 things you should know about North American gas to 2050 – Dulles Wang

Wood Mackenzie forecasts trillion-dollar boom in carbon offsets and CCUS markets by 2050

Quote of the week

“I hate to be politically correct because I see that as a constraint, as a barrier. It is fake… I hate the mainstream… You say the same thing everybody says, and if you do not say it, you are not in the right club. This is a way to stay stagnant. It is an empty box, and empty concept. In life, you have to challenge everything.”

Claudio Descalzi, chief executive of Eni, talked in an interview in the Financial Times about his career, the company’s strategy and his vision of the future of energy.

Chart of the week

This comes from a new note by Wood Mackenzie’s Peter Albin, Nuomin Han and Michelle Uriarte-Ruiz on the outlook for carbon offsets. It shows our projections for the supply and demand for offsets, and their prices, out to 2050. The market faces a host of near-term challenges that will limit the initial pace of growth, including offset quality, government regulation, corporate claims guidance and carbon removal deployment.

In the longer term, however, we still expect strong acceleration in growth over the coming decades. We project that offset demand could increase more than tenfold over the next 25 years. Download the full report for more details on the sources of future growth in demand and supply for offsets, and the price trends that are likely to emerge as a result.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.