Commodity Trading Analytics

Real-time monitoring and advanced analytics, providing the insights to identify opportunities and manage risk.

A new era of volatility and opportunity in commodity markets

Commodity markets are entering a period of rapid change, driven by shifting demand patterns, evolving supply chains, and new pressures from policy and energy security concerns. Volatility creates both risk and opportunity, making real-time visibility into infrastructure, trade flows, and price signals more critical than ever. Traders must react faster, with deeper insight, to capitalize on arbitrage opportunities and avoid unexpected losses. In a market where infrastructure constraints, regulatory shifts, and geopolitical events can upend strategies overnight, staying ahead requires a clear view of what’s driving change.

The clarity traders need

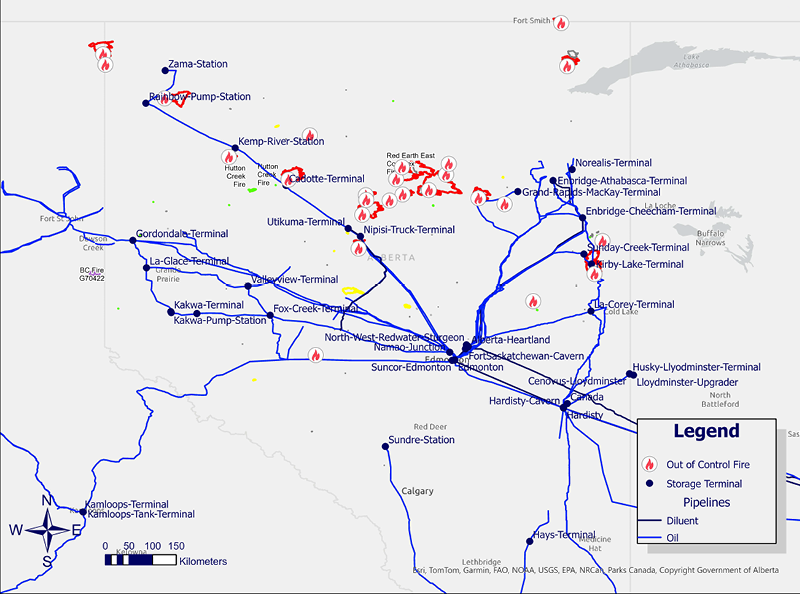

Leverage data and advanced analytics from our proprietary monitoring network – combining live camera feeds, infrared, satellite imagery and power line measurements – combined with expert insights across oil, gas & LNG, and power markets. Gain clarity amid shifting market dynamics, respond decisively and capitalise on new opportunities.

Confident trading, backed by a trusted partner

Our offerings combine real-time monitoring and forecasting, making them essential for IOCs and NOCs to small operators, banks, trading houses and hedge funds. Beyond delivering data, we provide the insights and context needed to understand market shifts, acting as a trusted partner in an increasingly complex trading environment.

Find the right product for your needs

Our solutions cover every aspect of the industry.

Trading moments

Stay ahead with the latest trading moments shaping the oil and gas markets.

Make smarter decisions in a volatile market with our bespoke consulting services

Expert advisory services with a global team of consultants, leveraging the industry standard – our data and research. We support customers in finding and developing opportunities and managing risks.

- Transaction support

- Commercial advisory

- Strategic advice

- Business environment and market evaluation

Contact an expert

In a volatile market, having the right data isn’t enough. You need a partner who provides the insights and context to turn market shifts into opportunities. Our monitoring and forecasting solutions help you navigate uncertainty, respond to disruptions and make smarter trading decisions.

Get in touch with one of our experts today.

Explore some of our latest thinking in commodity trading analytics

Loading...