Sign up today to get the best of our expert insight in your inbox.

Walking Japan’s energy tightrope

Balancing energy security, technology and costs

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

Joshua Ngu

Vice Chairman – Asia Pacific

Joshua Ngu

Vice Chairman – Asia Pacific

Joshua advises clients across upstream, gas, LNG, downstream, petrochemicals and energy transition.

Latest articles by Joshua

-

Opinion

Is Indonesia’s domestic gas supply in crisis?

-

The Edge

Walking Japan’s energy tightrope

-

The Edge

Five themes shaping the energy world in 2025

-

The Edge

What’s driving the upstream revival in Southeast Asia?

Alex Whitworth

Vice President, Head of Asia Pacific Power and Renewables Research

Alex Whitworth

Vice President, Head of Asia Pacific Power and Renewables Research

Alex leads our growing long term and short term power research team in Asia Pacific

Latest articles by Alex

-

Opinion

2025 global power market outlook: divergent paths in a transforming energy landscape

-

The Edge

Walking Japan’s energy tightrope

-

Opinion

Asia Pacific power & renewables: 5 things to watch in 2025

-

The Edge

Getting China back on track

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

Asia Pacific power and renewables: what to look for in 2024

Johnson Quadros

Head of Gas and LNG research

Johnson Quadros

Head of Gas and LNG research

Johnson is an LNG industry professional with 20 years of global experience.

Latest articles by Johnson

-

Opinion

How Asia will drive global gas and LNG investment to 2050

-

The Edge

Walking Japan’s energy tightrope

-

Opinion

Industrial demand, shrinking production fuel rise in Indian LNG imports

-

Opinion

Asia Pacific gas & LNG: 5 things to look for in 2025

-

Opinion

Gas & LNG in Asia: the next 10 years

-

Opinion

Will gas fuel Asia’s data centre boom?

Japan’s energy planning is uniquely complex. The world’s third-largest economy relies overwhelmingly on imports to supply a fossil fuel-dependent energy market, built through decades of massive infrastructure investment and meticulous planning. The 2011 Fukushima nuclear disaster and war in Ukraine in 2022 prompted Japan to double-down on energy security through imported coal, oil and gas.

Today, the power sector’s go-to market-ready low-carbon technology is renewables. Yet solar and wind developers face mounting obstacles to scale at pace, while it’s still early days for Japan’s nascent carbon capture and storage sector and the ‘hydrogen society’ vision recently set out by the government.

How will Japan meet its energy and decarbonisation targets with these challenges? Joshua Ngu, Vice Chair, Asia Pacific, asked Alex Whitworth and Johnson Quadros from our Asia Pacific research team about what the government’s latest Strategic Energy Plan (SEP) means for Japan and its energy partners.

First, the new plan recognises the realities of the transition

Issued every three years, the SEP steers the country’s energy outlook and aligns government policies with private sector investment. The 7th Strategic Energy Plan, released in December, provides, for the first time, multiple scenarios on how Japan’s energy outlook could develop. Included is a ‘Slow Technological Progress’ scenario reflecting a delayed energy transition due to limited progress with nascent technologies.

Second, nuclear is making a comeback

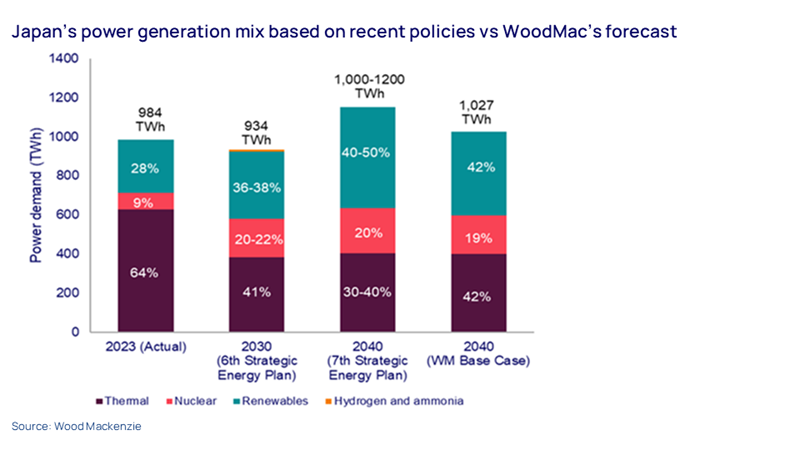

Japan remains fully committed to its 2050 net zero goals but is prepared to be pragmatic about how these are delivered. The previous target of up to 38% renewables (excluding nuclear) in the generation mix by 2030 from 26% in 2024 has now been pushed back by five to seven years as high costs, lengthy permitting processes and limited land availability slow the pace of growth. The latest plan now aims for 40% to 50% renewables by 2040, a more realistic target that aligns with Wood Mackenzie forecasts.

Nuclear is a different story. Following Fukushima, Japan’s nuclear power industry has been all but dormant – only a limited number of plants have been brought back online since. The latest plan hints at a nuclear re-awakening, emphasising the need to “maximise the use of both renewable and nuclear power”.

This translates to a 20% target for nuclear in the generation mix. While technically feasible, it will require restarting 20 GW of capacity that’s been offline since 2011, bringing all of Japan’s 33 GW of installed nuclear capacity back into service. Public concerns will need to be tightly managed.

Third, demand uncertainty will drive the need for flexibility in LNG contracts

Japan’s LNG imports had been expected to drop due to falling power demand and growth in renewables. However, the latest energy plan identifies potential LNG upside. Driven by AI-led data centres and wider electrification, Japanese electricity demand is now forecast to reach between 1,100 and 1,200 TWh in 2040, from 984 TWh in 2023.

With slower-than-expected growth in renewables, thermal power will remain in the generation mix for longer. Japan’s new energy plan now expects coal and gas to contribute as much as 40% of the generation mix by 2040, rising to 45% in the ‘Slow Technological Progress’ scenario. Japan will be in the market to seal export deals for carbon storage.

Wood Mackenzie’s base case forecast for LNG demand in 2040 is 54 Mt, which is at the lower end of the range implied by the latest SEP. However, based on the scenarios presented, there could be an additional demand upside of up to 20 Mt. This has major implications for LNG suppliers looking for buyers to underpin new projects, particularly given an increasing need for contract flexibility due to the uncertainty in domestic demand growth.

Fourth, resilient LNG demand is encouraging more M&A activity

Japanese upstream M&A activity slowed noticeably between 2020 and 2022, with only six deals completed in the wake of the pandemic and uncertainty around Japanese oil and gas demand.

Japan’s focus on energy security and affordability is encouraging domestic E&P companies back to the market as major asset acquirers. Activity has picked up with Japanese involvement in eight deals, including three significant gas and LNG deals last year by Mitsubishi, Mitsui and JERA. The latest energy plan could fire the starting gun for more deals to secure gas and LNG assets.

Fifth, Japan’s energy security extends beyond fossil fuels

The latest plan places significant weight on securing critical minerals for the energy transition. Copper and battery raw materials are highlighted as essential for Japan’s economic transformation and decarbonisation, with the government making funding available for Japanese companies to secure volumes and overseas assets.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.