Sign up today to get the best of our expert insight in your inbox.

Nigeria’s bold strategy to double oil production

Culture change is aimed at boosting investment

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

Mansur Mohammed

Africa Upstream & Carbon Management New Business Development

Mansur Mohammed

Africa Upstream & Carbon Management New Business Development

Mansur is the Head of West Africa Upstream Content, Sub-Saharan Africa Oil & Gas.

Latest articles by Mansur

-

The Edge

Nigeria’s bold strategy to double oil production

-

Opinion

Navigating Nigeria’s changing oil and gas landscape

-

The Edge

Financing the next phase of Africa’s oil and gas development

-

Opinion

The key factors shaping investment in Africa’s upstream industry

-

Opinion

Three critical factors to developing Africa’s oil and gas resources

David Parkinson

Vice President, Upstream Consulting

David Parkinson

Vice President, Upstream Consulting

David leads our exploration strategy team and is also responsible for exploration consulting.

Latest articles by David

-

The Edge

Nigeria’s bold strategy to double oil production

-

Opinion

Emboldened and disciplined exploration: results from our Future of Exploration 2024 Survey

-

Opinion

Three critical factors to developing Africa’s oil and gas resources

-

Opinion

Can carbon offset crude move from idea to reality?

-

Opinion

What is the future of oil and gas exploration?

Richly endowed with resources, Nigeria not so long ago was among the most important sources of oil and gas production for Big Oil. National liquids production, though, has fallen by 40% from its 2005 peak to 1.6 million b/d currently. And the downward trend accelerated as IOCs reallocated capital towards lower-cost, lower-risk basins in the wake of the oil price crash after 2014.

Signs of the positive change in the industry emerging under the leadership of President Bola Tinubu were evident at Wood Mackenzie’s 7th Annual Nigeria Upstream Briefing in Lagos earlier this month. Our Upstream experts, Mansur Mohammed and David Parkinson, shared with me their perspective of what’s afoot.

Elected in 2023, in his role as Federal Minister of Petroleum Resources, President Tinubu has set ambitious new oil and gas production targets – 3 million b/d of liquids and 12 bcfd of gas by 2030. A culture change has begun with sweeping changes to the board at national oil company NNPC, more supportive fiscal policies and a suite of new JV operators suggesting the ingredients to drive growth are finally falling into place. The big question is: will the industry deliver?

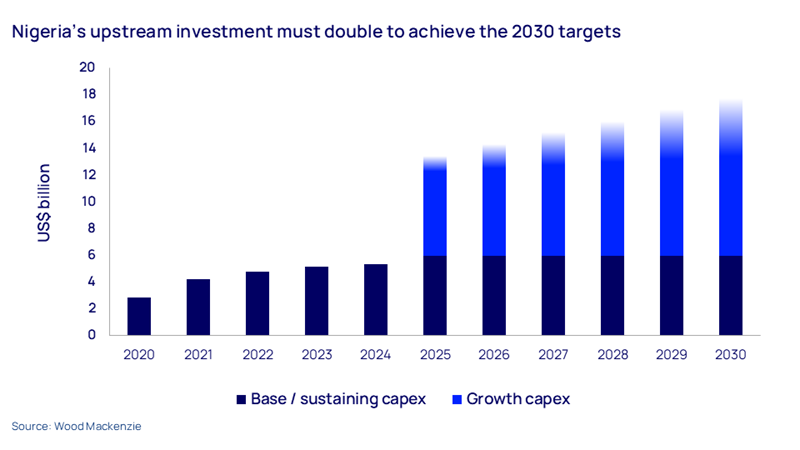

Investment has suffered a steep fall from a peak of US$29 billion (real) in 2014 to just over US$5 billion in 2024. We believe the latter is the absolute minimum required merely to sustain current levels of production. But to achieve the president’s targets, spend needs to more than double to US$12 billion a year immediately and continue growing for the rest of the decade.

There are already signs that things are moving in the right direction. Renaissance Africa Energy Company alone plans to invest US$15 billion over five years, and we expect an uptick in activity by Oando and Seplat from their recently acquired assets. Shell has committed US$5.5 billion at Bonga North and ExxonMobil could commit up to US$10 billion on the Usan, Owowo and Erha fields.

Indigenous firms are producing more volumes than expected from their marginal fields. Even so, this group of companies now need to embrace a culture of growth. Our discussions with the industry identified several of the key areas the industry, and government, must focus on:

Collaboration

NNPC can’t do it alone, it will require collaboration to unlock the growth potential. All operators must bring forward their top opportunities and work programmes. A common understanding and line of sight to where the incremental volumes will come from is a priority. Only then can partnerships and investment unlock synergies and tackle bottlenecks that have eluded the industry in the past.

Urgency

With 2030 targets looming, there is no time to lose. Delays in signoffs and overbearing regulatory burdens can no longer be tolerated. Incentives provided to the industry are a good start, but the fiscal system remains complex and Nigeria is competing in a buyers’ market.

Pragmatism

A recent success story in West Africa has been Angola, where the regulator has boosted activity by engaging with the industry, offering more competitive terms and structured and regular licensing. For greenfield opportunities to be part of Nigeria’s solution by 2030, two shifts are required – rapid signoff of development plans and pragmatism when challenging regulatory requirements become a blocker. New production sources must be given priority.

Not everything needed to get to the targets are under the government’s or industry’s control, of course. Volatile oil prices are already taking their toll on discretionary upstream spend globally. Moreover, many of the Nigerian indigenous companies have taken on considerable debt to acquire assets. But there is limited capacity for debt-fuelled growth, particularly in what remains one of the higher-cost and higher-risk oil and gas plays. The most viable route to accelerating growth is recycling cash flow from operations back into the assets, which is dependent on firm and stable oil prices.

Nigeria’s goal to not just maintain existing oil production but to add another 1.3 million b/d and 4.6 bcfd of gas production in five years is admirably ambitious, considering the travails of the recent past. Even if Nigeria gets halfway towards its targets, it will be significant success and would restore the industry’s faith in the country.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.