Sign up today to get the best of our expert insight in your inbox.

The case for high-impact exploration through the downturn

Success in value creation justifies countercyclical investment

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Slipping climate targets and the “energy addition”

-

Opinion

Energy's interconnected future demands integrated intelligence

-

The Edge

China renewables investment powers on

-

The Edge

NOCs begin a new phase of upstream internationalisation

-

The Edge

How AI can unlock an extra trillion barrels of oil

-

The Edge

How data centre growth is driving up US power prices

Simran Bandal

Senior Analyst, Subsurface

Simran Bandal

Senior Analyst, Subsurface

Latest articles by Simran

-

Opinion

SEC 2025: Why the SEAPEX region still needs high-impact exploration

-

The Edge

The case for high-impact exploration through the downturn

-

The Edge

How ultra-deepwater is revitalising oil and gas exploration

The latest dip in oil prices presents a fresh test for oil companies’ investment plans – how to balance short-run capital discipline with long-term value creation? Oil prices are set to average US$60-65/bbl on our forecasts through 2026, US$15-20/bbl lower in 2025 and 2026 than last year. After dividends, that’s perilously close to the sector’s average cash flow breakeven Brent price of US$62/bbl.

Discretionary spend is invariably the go-to lever to protect dividends and the balance sheet as cash flow dips. As well as pre-FID projects, exploration budgets will be examined for wiggle room. Simran Bandal, Senior Analyst Exploration, argues that companies should be wary of a knee-jerk reaction.

First, the world needs sustained investment in exploration

Weaker oil demand in the next year or two resulting from the Trump administration’s proposed tariffs is likely to be transitory. Oil demand will continue to grow incrementally. As producing fields decline, we forecast a liquids supply gap of at least 20 million b/d by 2034. Continued exploration success is essential to ensure low-cost, low-carbon-intensive barrels from new discoveries help to fill the gap rather than relying solely on existing undeveloped resources, much of which are more costly and dirtier.

Second, the industry has become much better at exploration, technically and commercially, in the last decade – and it’s done this by focusing on value rather than volume

Prospects proposed for drilling have to meet strict investment criteria including internal rate of return, payback timeframes, projections of future carbon pricing, minimum breakeven thresholds and emissions intensity. The checklist will continue to evolve.

The results speak for themselves. Despite halving exploration and appraisal spend between 2019 and 2023 compared with the previous five years, the industry delivered the same volumes – just under 100 billion boe – from discoveries. More importantly, average full-cycle returns leapt from 11% to 17% with Eni, the most consistent performer.

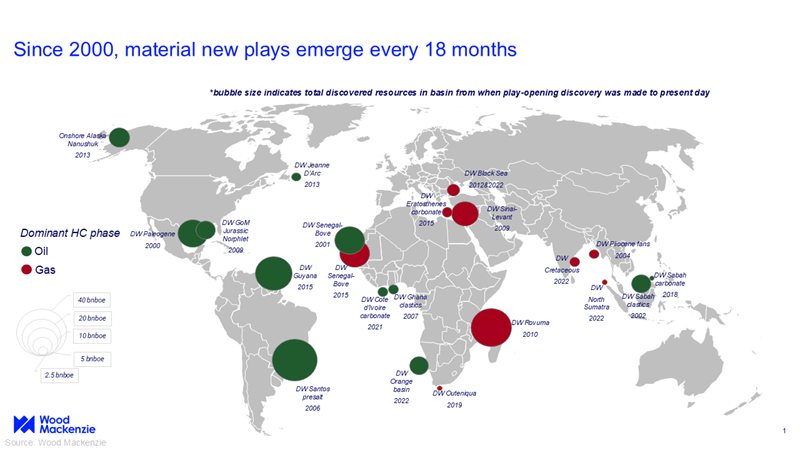

Third, capital discipline hasn’t stopped the industry opening up new geological plays

Billion barrels of oil equivalent (boe) discoveries are emerging every 18 months on average this century. The biggest resource capture theme outside of US shale has been the push into under-explored frontiers in search of big fields, typically in ever-deeper water. It’s been highly successful for the first movers and fast followers.

Ultra-deepwater discoveries in more than 1,500 metres, for example, are four times larger on average than those on the continental shelf. These have contributed by far the most value creation for the leading IOC explorers in the last five years. ExxonMobil and Hess (Guyana), Eni (Côte D’Ivoire, Indonesia, Cyprus) and TotalEnergies (Namibia) each created at least US$5 billion of value between 2019 and 2023 on our calculations.

National oil companies have also participated in significant ultra-deepwater success with CNOOC (Guyana and China’s Qiondongnan basin), Qatar Energy (Namibia) and TPAO (Türkiye) among the leaders.

Fourth, a dip in exploration performance in the last couple of years can be attributed to a conservative approach to reserve estimates for new discoveries

Numbers for commercial discoveries tend to go up over time as additional appraisal wells are drilled. Another factor is dwindling prospect inventory in 2021 and 2022, as companies became wary of replenishing portfolios, given net zero goals and the prospect of a peak in oil demand seemingly not too distant.

That’s changed as the pace of the energy transition moderates and energy security is again top of the agenda. Companies with new acreage are refocusing on high-impact exploration. Among the numerous high-impact wells we expect to be drilled over the next 12 months, these – mostly 1 billion-plus boe-potential prospects – are among the most exciting.

Orange Basin (Namibia/South Africa):

The hottest play on the planet, thanks to massive discoveries in Namibia over the last three years and the country’s supportive fiscal terms. TotalEnergies (with Qatar Energy) will test the extension of the proven Cretaceous fan play in Namibia into South African waters with the Volstruis-1X and Nayla-1X wells in 2026. Though the Namibian reservoirs are proving enigmatic, explorers are pressing on. TotalEnergies will drill Olympe, southwest of its giant Venus discovery. Rhino Resources has up to three more wells to drill starting from December, following its promising Capricornus-1 discovery.

Walvis Basin (Namibia):

Chevron will drill a potential basin-opener in its PEL 82 licence.

São Tomé and Príncipe:

Shell’s Falcao prospect (1.5 billion boe, oil) is targeting deepwater clastic turbidites in the Douala Basin.

Suriname:

TotalEnergies’ Macaw prospect (1.0 billion boe, oil) will test an unproven carbonate play in deepwater; Shell’s Araku Deep (1.0 billion boe, oil).

Exploration teams have sharpened their focus, but high-impact exploration is still high risk – as many as three-quarters of these wildcats will not be commercial successes. But with potential discoveries worth many tens of times the cost of their exploration wells, that’s a risk the companies are happy to take.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.