Get Ed Crooks' Energy Pulse in your inbox every week

The Trump administration remakes US environmental approvals

New procedures will replace regulations that have been in effect since the 1970s

7 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Energy companies seek answers amid US tariff uncertainty

-

Opinion

The growth of energy storage seems unstoppable

-

Opinion

Pressure builds on US energy tax credits

-

Opinion

The Trump administration remakes US environmental approvals

-

Opinion

What do President Trump’s tariffs mean for energy?

-

Opinion

US tariff announcements add to uncertainty

The US National Environmental Policy Act (NEPA) of 1970 has been described as the “Magna Carta of federal environmental law”. It requires federal agencies to assess the environmental impact of their actions and creates opportunities for the public to influence government decisions. For the energy and natural resources industries, it is one of the key laws for deciding whether or not a project can proceed.

Since taking office a month ago, President Donald Trump has thrown the framework for implementing that law up into the air. The goal is a more efficient system for environmental approvals that will expedite critical infrastructure projects. But while the details are being worked out, businesses will face increased uncertainty.

When he signed NEPA into law on 1 January 1970, President Richard Nixon said his aim was “to restore the cleanliness of the air [and] the water” with bipartisan support. Regulations introduced by the Carter administration in the late 1970s established procedures for implementing the law, and with various modifications, those rules have formed the basis for the US system of environmental approvals ever since.

On his first day in office, however, President Trump announced that he was scrapping those regulations, as part of his executive order on ‘Unleashing American Energy’. This week, the administration gave more details of what that means.

The central role previously given to the White House Council on Environmental Quality (CEQ) has been abolished, and individual government agencies will be free to decide on their own procedures for implementing NEPA.

That does not mean a complete free-for-all. Agencies are being asked to follow the NEPA regulations introduced by the first Trump administration in 2020. They have also been told to comply with the Fiscal Responsibility Act of 2023, which set deadlines for completing environmental reviews: a year for the simpler environmental assessments, and two years for the more complex environmental impact statements.

Katherine Scarlett, the chief of staff at the CEQ, this week sent out a memo instructing federal agencies to “continue to follow their existing practices and procedures for implementing NEPA”, subject to those other requirements, while they work on the new revised rules. She added that agencies should “not delay pending or ongoing NEPA analyses while undertaking these revisions”.

That should mean that, initially, businesses will not see too much difference. Over time, however, government agencies will come up with new procedures for implementing NEPA, and that could lead to significant changes.

The courts are also likely to have a role to play because any procedures the administration puts in place face a high risk of legal challenges.

One complicating factor will be the Supreme Court’s decision last year to reject the long-standing principle of “Chevron deference”. That is, when a law is ambiguous, the courts should be inclined to accept any reasonable interpretation used by the administration. Abandoning that principle gives the courts more responsibility for interpreting the law and could make it easier to challenge government decisions.

The Wood Mackenzie view

Over the past decade, new investment in some types of energy infrastructure in the US has plummeted. Data compiled by Wood Mackenzie show that in 2014, the US added 2,932 miles of new electricity transmission lines. By last year, that was down to just 339 miles.

The data for annual additions of new gas pipeline capacity show a similar picture of steady decline since the 2010s. There was a pick-up last year, but that largely reflected the Mountain Valley pipeline from West Virginia to Virginia, which required a vote in Congress to help clear away the remaining obstacles.

Procedures for implementing NEPA are not the only reason investment has slowed. The law has created ample opportunities for opponents to obstruct infrastructure projects. The proposed Keystone XL oil pipeline was repeatedly delayed over its environmental impact statements, required under NEPA, before finally being blocked by President Joe Biden.

Many in the industry would welcome a new framework for NEPA implementation that prevents this kind of dragged-out process.

However, many of the obstacles to infrastructure investment in the US are created by states and local communities, not by the federal government. Even when a new federal system is in place, that will not mean an immediate surge in investment in climate-focused states such as New York and California, says Eugene Kim, Wood Mackenzie’s research director for American gas.

President Trump has signalled a willingness to take on those states that resist new fossil fuel infrastructure. His executive order on energy highlighted the need for increased pipeline investment, “particularly in regions of the Nation that have lacked such development in recent years”. But that strategy would also face opposition and legal challenges.

When Chris Wright, the energy secretary, set out his vision for his new department earlier this month, he identified permitting and construction of energy infrastructure as one of his top priorities. The nation needed to “remove barriers to progress, including federal policies that make it too easy to stop projects and far too difficult to complete projects,” he said.

Reform of the NEPA regulations should help the administration make progress towards that objective. But abandoning procedures that have been in place for more than four decades inevitably raises uncertainty over how the consequences will play out.

In brief

President Trump has issued another order to reshape the structures of the US government, asserting his control over all government agencies. The order asserts that the “so-called independent agencies”, including the Federal Energy Regulatory Commission (FERC), will, in future, have to submit proposed regulations to the White House for review. They will also be required to consult with the White House on their priorities and strategic plans, and the White House will set their performance standards. The White House said presidential control of the agencies would “increase regulatory officials’ accountability to the American people”.

Mark Christie, appointed chairman of FERC by President Trump in January, played down the impact of the order. Speaking to a press briefing on Thursday, he said: “A lot of this in the EO [Executive Order] is basically putting in one place past practices that have been going on for years… We have complied with presidential EOs for decades.”

The US oil and gas industry could be given increased tax breaks in a new budget package, President Trump said. Speaking at a conference in Miami, the president also raised the prospect of 100% expensing for capital equipment. “If you buy something that is going to be good for our country, we're going to let you expense it,” he said.

Brazil’s government has agreed to join the OPEC+ group of oil-producing nations for discussions about strategy, but will not be taking part in any agreements on production cuts. Alexandre Silveira, Mines and Energy Minister, said: “We should not be ashamed of being oil producers. Brazil needs to grow, develop and create income and jobs.” Brazil’s oil production has risen from about 2 million barrels per day in 2009 to about 3.75 million b/d this year and is still growing.

Other views

What next for East Med gas? – Simon Flowers and Gavin Thompson

The big question for onshore wind: what to do with ageing turbines? – Charles Coppins

Energy transition outlook: Middle East – Jom Madan

Record-breaking 1.7 GW of US community solar installed in 2024

Will Europe return to Putin’s gas?

Quote of the week

"Because of the conflict in Ukraine and the war in the Middle East, even fossil fuels have become difficult to buy… Japan is a country without energy resources, so we must use whatever is available in a balanced way."

Japanese MP Daishiro Yamagiwa, who sat on a government advisory committee on energy strategy, explained to the BBC the reasons why he supported an expanded role for nuclear power. The government is now recommending an increased share for nuclear in Japan’s energy mix, reversing part of the contraction that followed the Fukushima disaster in 2011.

Chart of the week

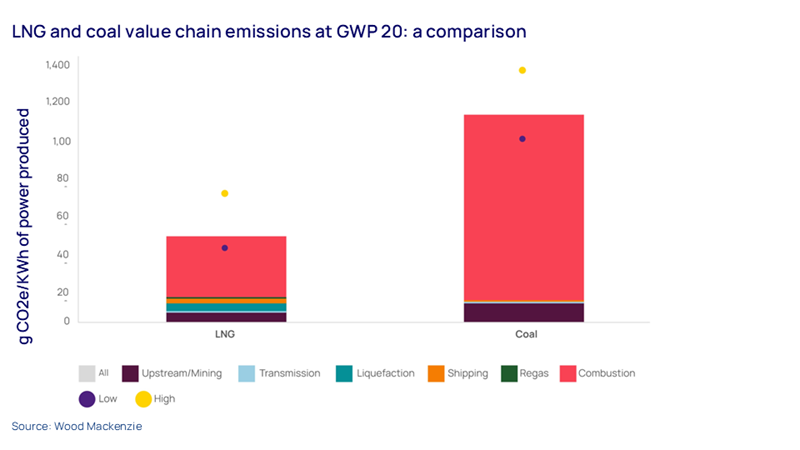

This chart addresses one of the hottest topics in global energy and climate policy. It comes from our new Horizons report ‘The bridge: Natural gas's crucial role as a transitional energy source’, and compares full value chain emissions from LNG and coal when used for power generation.

Our analysis shows that, on average, LNG used for power generation has a greenhouse gas (GHG) intensity that is 60% lower than coal. But it is a complex picture with many nuances to it. Take a look at the full report to dig further into the debate.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.